Néologique believes that the data we have created provides a unique and innovative perspective on the aerospace C-Class parts market. We have grouped together summaries by themes (acquisition, supply chain...) immediately below and individual data associated with a particular slide can be reviewed by scrolling further down. Thanks for taking the time to visit our website.

Find an Acquisition that Fits

The C-Class parts market has seen 72 M&A transactions over the last 10 years with 83 entities disappearing, either through an acquisition or a market exit. 60% of all transactions were completed by 18 entities which is confirmation that consolidation is an ongoing and thriving strategy. The ability of players to compete in the global market demands a broader product portfolio, enhanced purchasing power and geographic presence; factors that drive consolidation. At Néologique we believe that investment into the C-Class parts market will continue its growth cycle, following the low level of activity in 2020.

additional info below

Know your Market

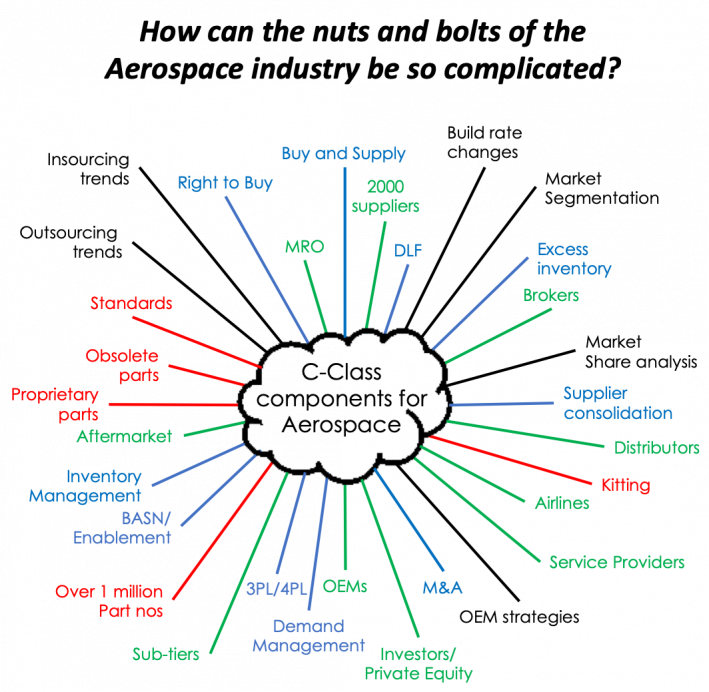

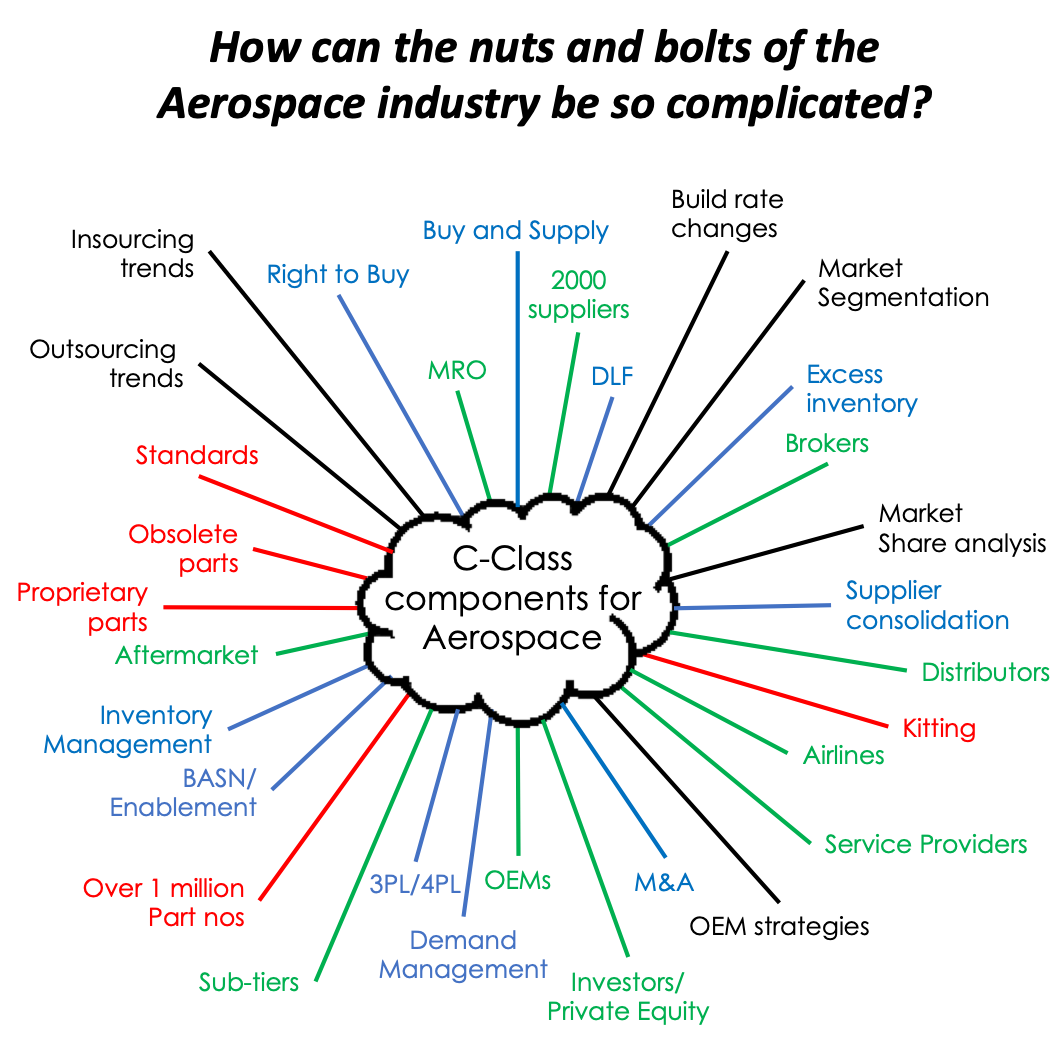

The C-Class market is complex and disproportionately so considering the value of the parts. The notion that a $0,10 rivet can stop an aircraft production line is unbelievable but a reality. This complexity is really only understood by the players in the market and it drives the supply chain in terms of channels to the market and services provided by both distributors and manufacturers. If you would like to know more about the market, the products, the key trends and influencers or the players, then contact Neologique.

additional info below

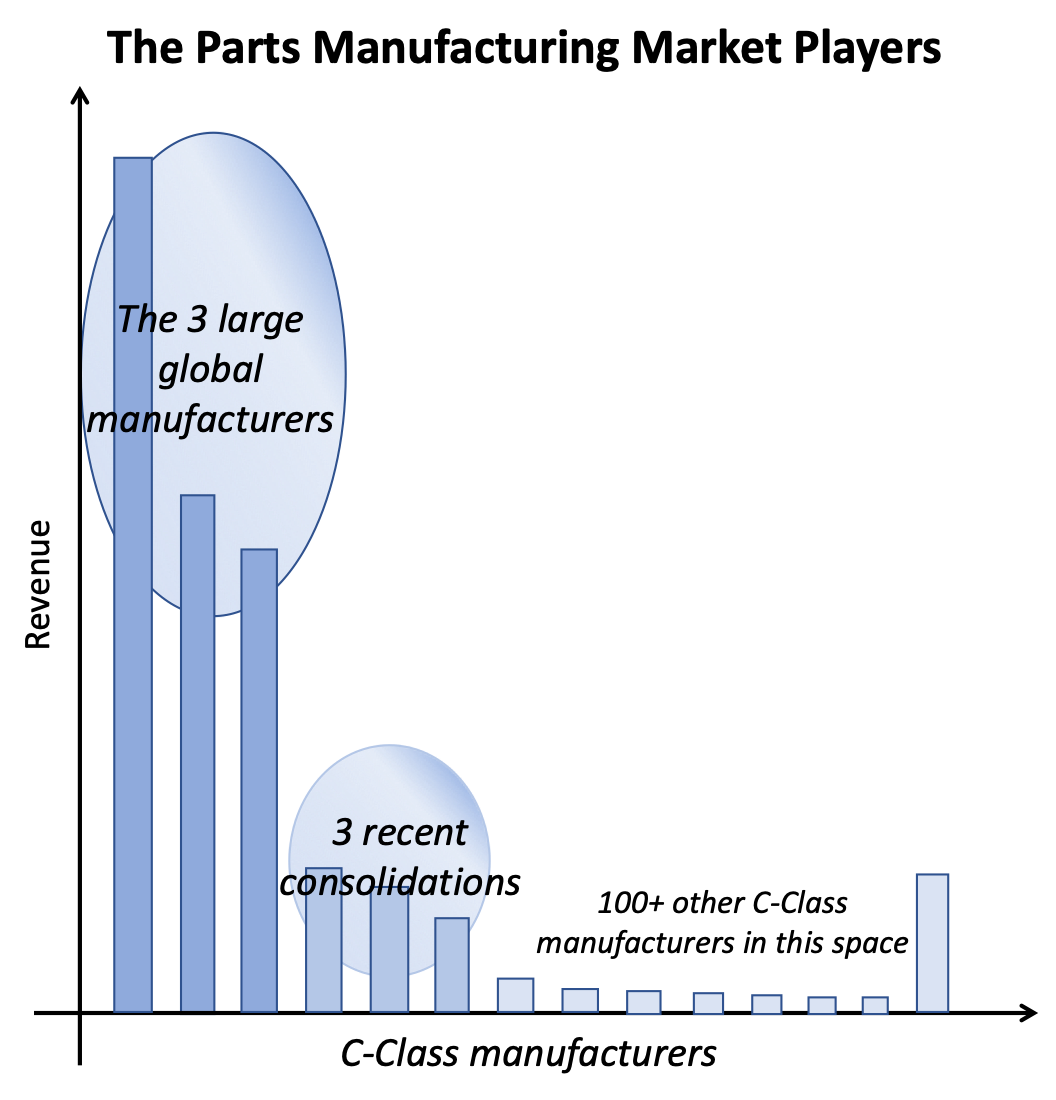

Who are the players?

The C-Class parts market comprises parts manufacturers and their distributors or service providers. At a customer consumption level the market is split approximately 50/50 between the manufacturers and distributors. The manufacturing arena is dominated by 3 large players, Howmet, PCC and LISI and the distribution world is led by 2 suppliers, Incora and Boeing Distribution Services (BDS). Active consolidation starts to bridge the gap between the bigger suppliers and the rest, but it will take time.

additional info below

Optimize your positioning

Where you are positioned in the market is fundamental to the development of your business strategies. Being a niche player in a certain sector or geographic region is a short term approach which ultimately will lead to you being marginalized or swallowed by a bigger player. Participating on the global stage means that you have to have the capability and leverage to do so. Invest in new products, technology, production capacity or inventory or take a look at the market positioning of those around you and acquire a business that will make a difference.

additional info below

Understand the Supply Chain

Why do distributors exist in this market? Why is the relationship between manufacturers and distributors often fraught and rarely strategic? The answers to these questions lie in the understanding of the supply chain and the dynamics driven by the customers forecasts and demand. Will the end-users continue to provide approximative forecasting at a part number level? And will the parts manufacturers continue to provide poor levels of service that drive the customers to the distribution channel? When will AI provide all the answers and what will the outcome be?

additional info below

The “Nuts and Bolts” of the Industry

There are far too many families of products to look at them individually so we have focused here on just a few of the widely used families. Over years of development it is interesting to see how the larger players can offer virtually all standard components plus a range of their own proprietary parts. The parts manufacturers continue to strive for new product introduction through R&D investments. The impact of a successful new product introduction on the supply chain can be huge. What do you have to do to get into this market? A big investment in plant and qualification testing over a number of years and a vast amount of technical and manufacturing knowhow.

additional info below

See more details below

Complexity

The complexity of the supply chain relative to low value/high volume components effects each player in the market in a different way. An investor may view the sector as an opportunity, providing barriers to entry and attractive, steady year over year growth since the 1950’s. An OEM would see the risk of crucial but low value parts, if not managed correctly, stopping the production of the world’s largest aircraft. The distributor would prioritise its working capital utilisation and margin opportunity while the manufacturer of C-Class parts will continue to look for production efficiency and economic lot manufacturing whilst innovating and developing new proprietary products.

Wherever you fit within the supply chain, Neologique can help you put everything into perspective so that your priorities crystallise. Whether it is the impact of further industry consolidation, or the upstream investments of OEMs, or the ongoing outsourcing trends, we have a unique insight into the industry.

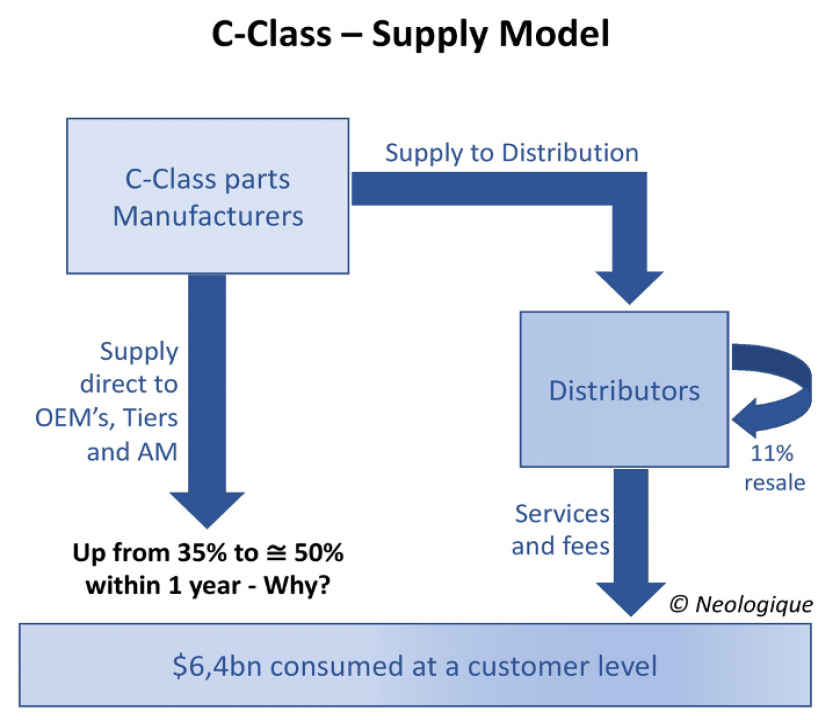

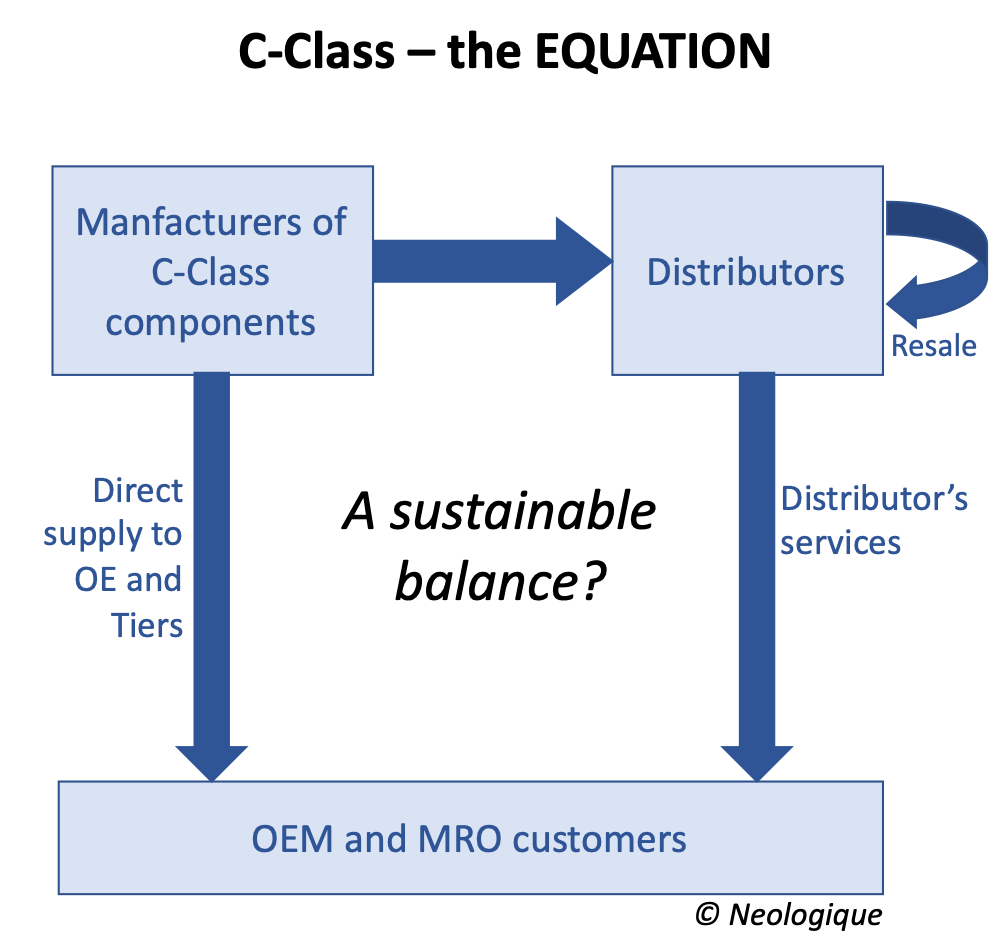

Supply Equation

How much product flows through the distribution channel and why? Why can’t the manufacturer provide the entire global demand directly to the end-user? Will the situation be stable over the next 10 years? Does the move to outsourcing decline and what sort of services will be supplied by the distributors? What is the impact of the MRO requirement and how should it be consolidated globally? What are the consequences of new comers initiatives in 3PL, 4PL, 5PL?

At Neologique, we believe it is a fundamental requirement to understand this equation and its drivers. How has it evolved? How has the ability of the distributor to invest in inventory changed and will the potential for the distributor grow given recent insourcing activity and consolidation?

In addition, it is clear that the product type should determine its own channel to market, but to what degree is this true? And does the prevailing commercial pressure always win?

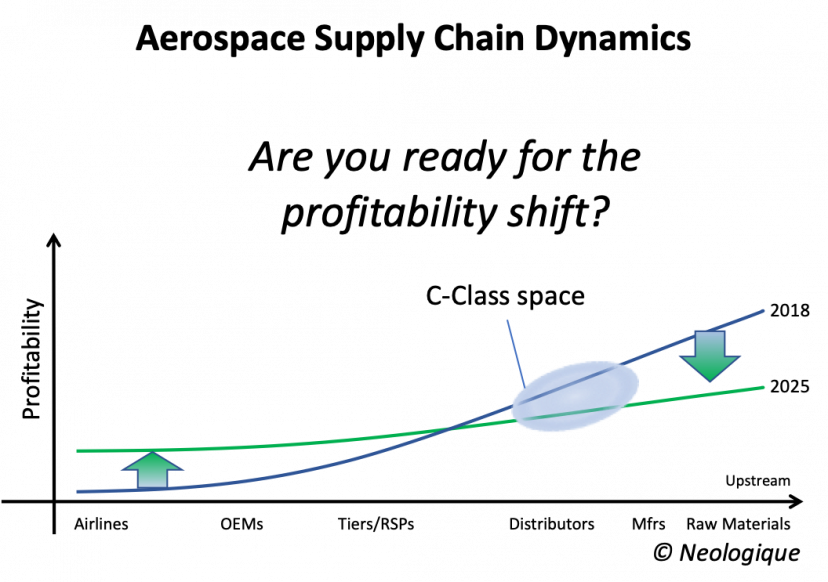

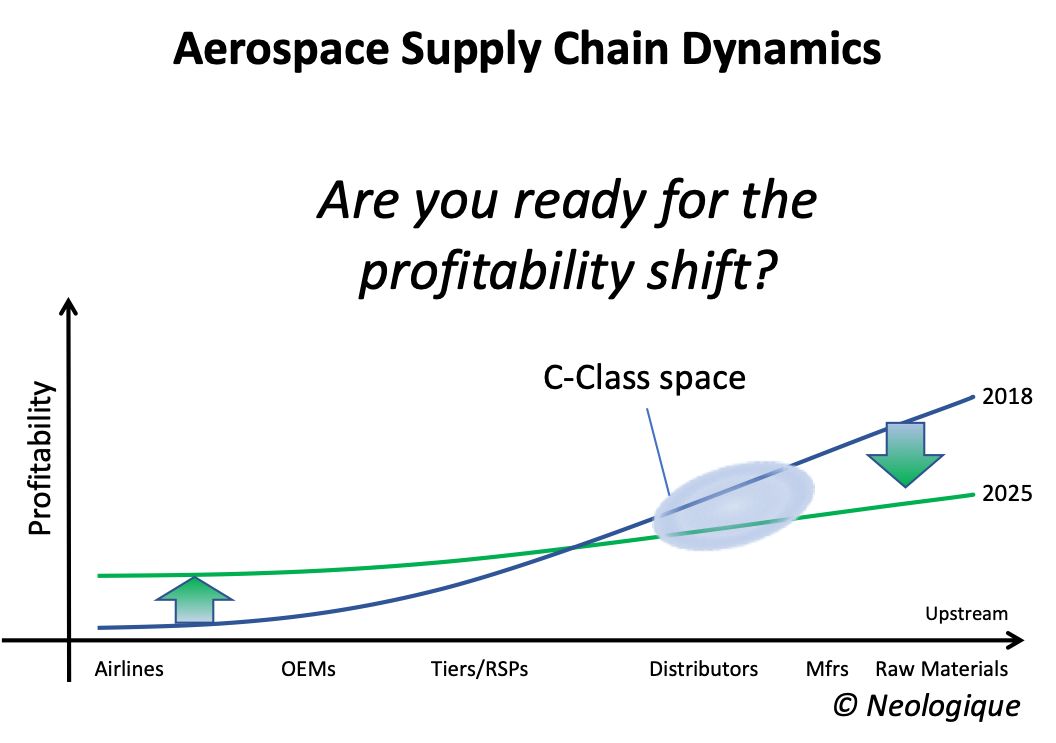

Fights in the value chain

The actions and reactions of Airlines, OEMs, Tiers, Distributors/Service providers and Manufacturers tend to rotate the profitability curve. Where is the pivotal point?

For Distributors & Manufacturers, how to best counter OEMs & Tiers pressures? Further consolidation? For OEMs and Tiers, how to best manage the supply chain? Invest upstream? Investors should be aware of these frictional dynamics.

Neologique believes that players need to understand all interfaces within the value chain and where the coefficient of friction is at its highest. The development of strategies depends on this knowledge.

Forecasting

Will the OEM continue to provide approximative forecasting at a part number level? Will the parts manufacturers continue to provide service levels that drive the OEMs to seek alternative supply solutions, and at the same time find a mitigation for the resulting excess inventories? Will the relationship between parts manufacturers and distributors continue to be volatile? And will distributors embrace 4PL and 5PL initiatives?

These questions may not need answers when artificial intelligence provides the solution!

At Neologique we believe that the OEM cannot provide an accurate demand for its C-Class parts, particularly in the airframe sector and in any sector where the MRO demand is erratic. Who then takes the responsibility for these inefficiencies? Who is paying for these inefficiencies? What role will AI have in the future?

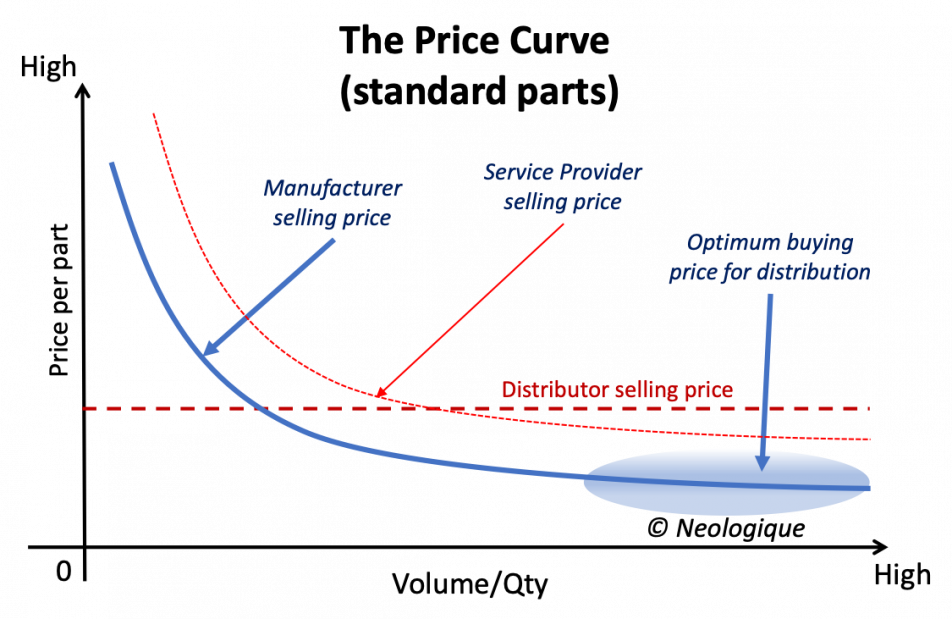

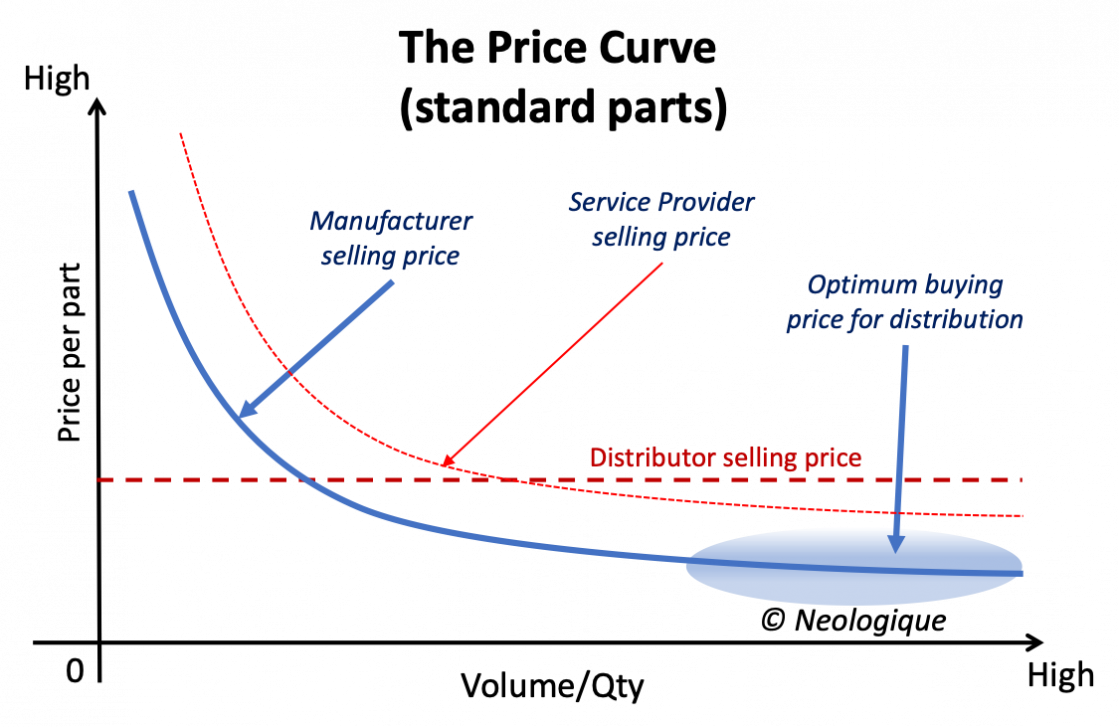

Price Curve

Did you know that this price curve applies to virtually all standard, non-standard and proprietary C-Class components including bolts, nuts, screws, rivets, washers, Hi-Lok/Hi-Lite/Veri-Lite/Lockbolts pins and collars, 12 point bolts, blind bolts, blind rivets, panel fasteners and inserts? The risk a distributor takes in buying at the optimum purchase price, can be considerable in terms of Working Capital and obsolescence, but the rewards can be high if they get it right. How to get it right all the time?

Whilst the manufacturing constraints are clear, are the manufacturers sure about their MOQ, and is the MOQ always at the risk of those down stream? Who pays for that?

At Neologique we think that there is an optimum purchase price for each product and a margin that is commensurate with the WC risk, according to the served market segment. Service Providers “service fee” or “management fee” is shown on the chart and it becomes clearer when considering this model how and why distributors have migrated into the services activity. It is more of a challenge to move in the other direction.

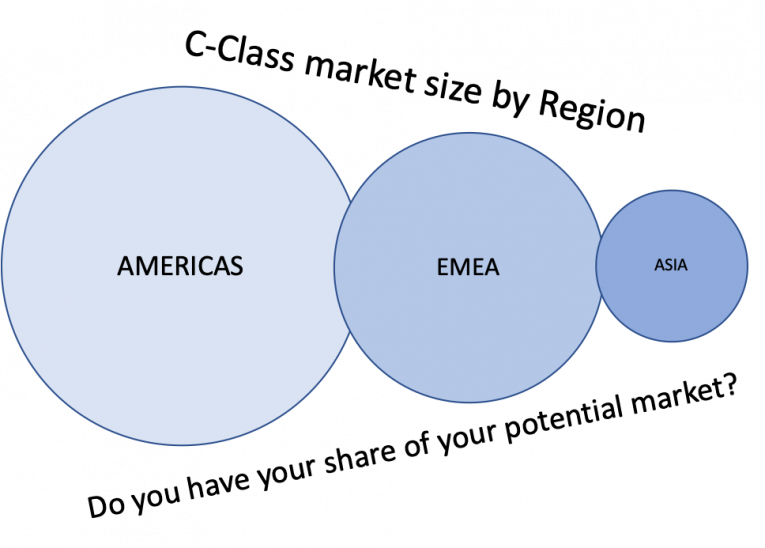

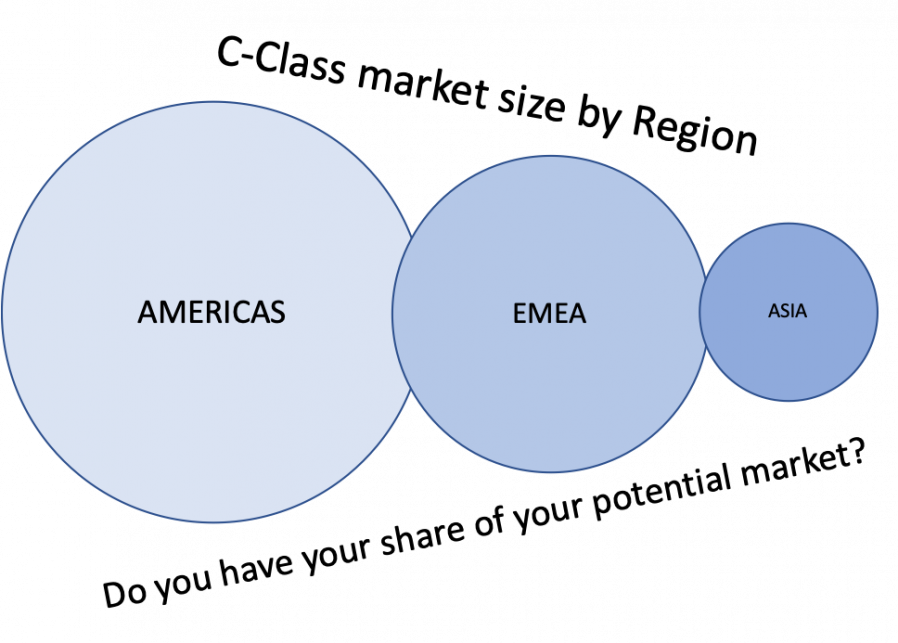

Regional Markets

If you are a USA based parts manufacturer or distributor, without a direct presence in the EU and Asia, why not take advantage of the opportunities out there? Likewise, if you are based in the EU or Asia, have you thought of how you can expand into the Americas?

Globalize your business before someone else takes the opportunity away.

Neologique believes that it is important to act globally in the aerospace market and we think that it isn’t sufficient if you are a manufacturer located in a region to simply have a representative in another region. Maybe you need to acquire an adjacent product line or operation, because a real investment in the target market will reap reward.

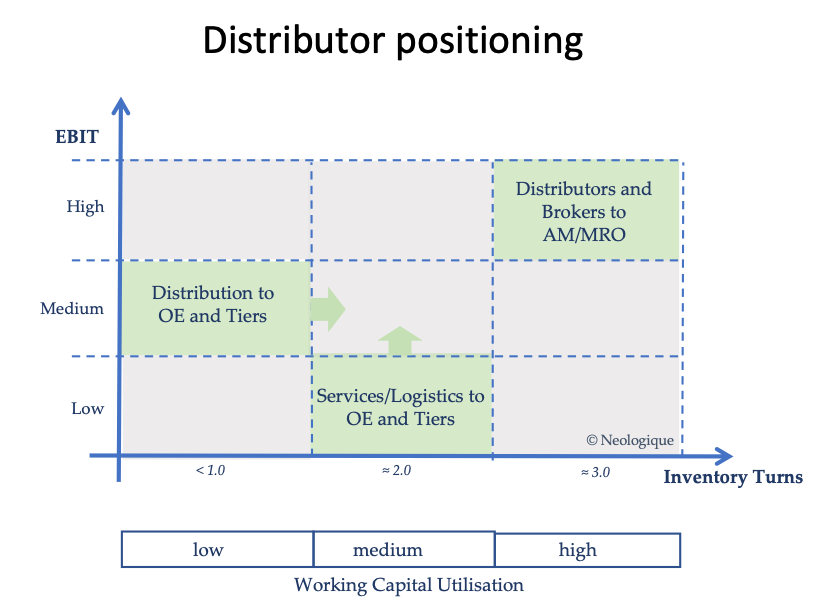

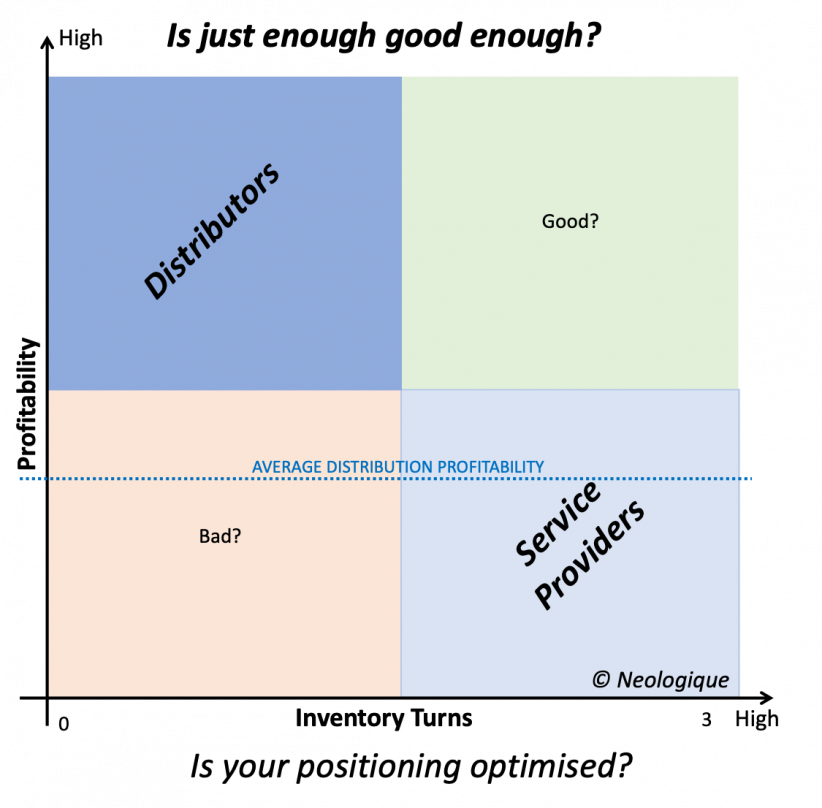

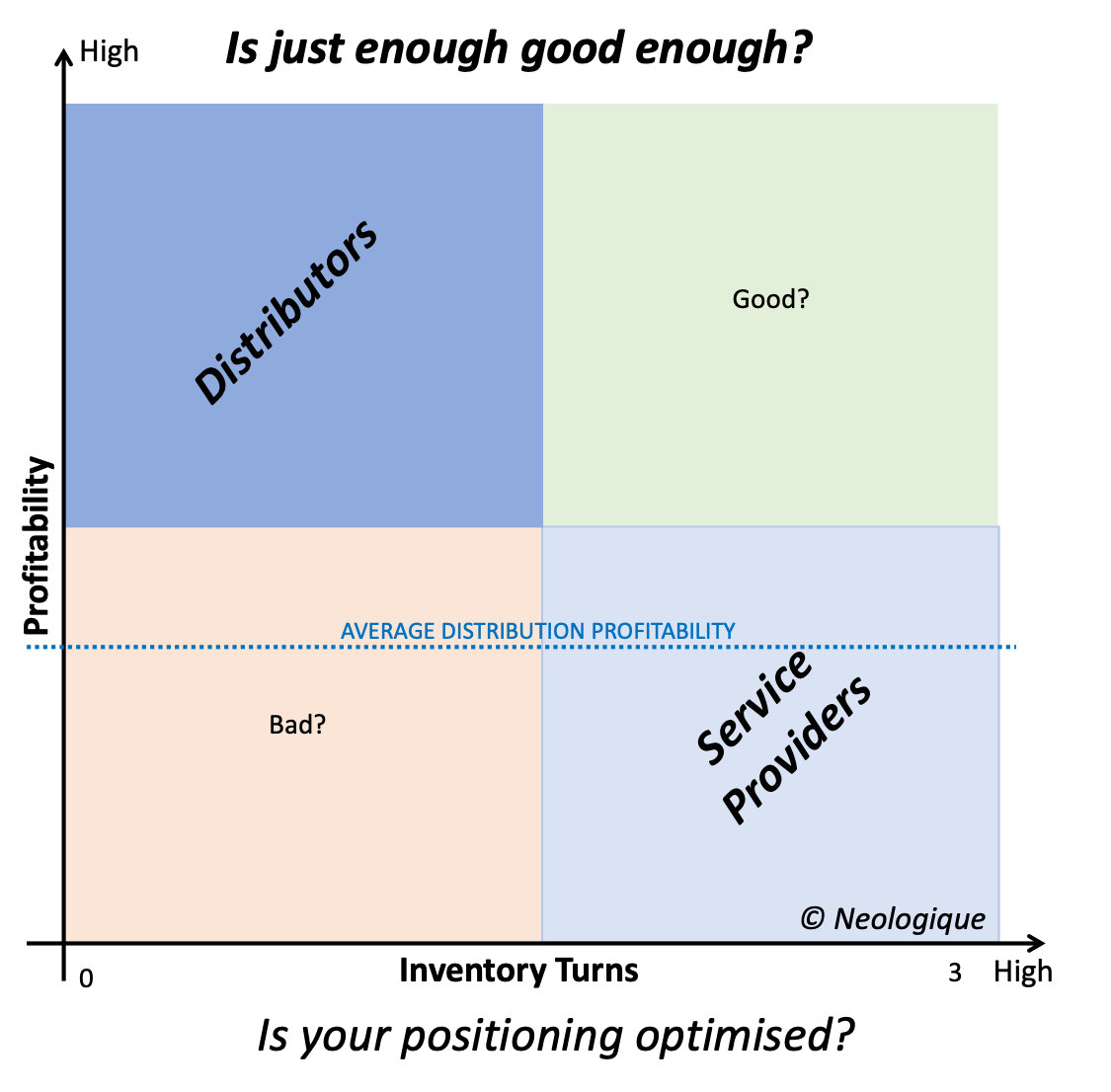

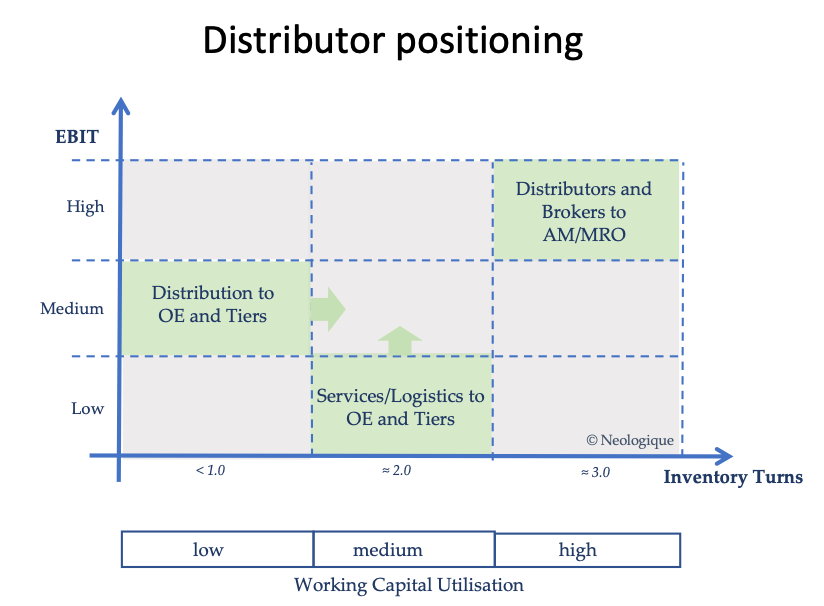

Distributor and/or

Service Provider ?

How to optimise inventory turns and margin realisation? The key lies in the clarification of how distribution wants to be positioned relative to inventory.

How can parts distribution and service provision be harmonious and complementary? Distribution focuses on parts and purchasing strategy, while distributors providing services focus on service and service fees regardless of the product. Both, of course, have inventory at the core of their activity, but one loves inventory and one hates it.

At Neologique we think that there is an optimum and sustainable balance between Distribution and Service Provision. The answer is in the desire to manage both types of activity at a PART NUMBER level. Optimised purchasing will yield margin enhancement and improved working capital utilisation. And adopting such an approach across both activities adds value

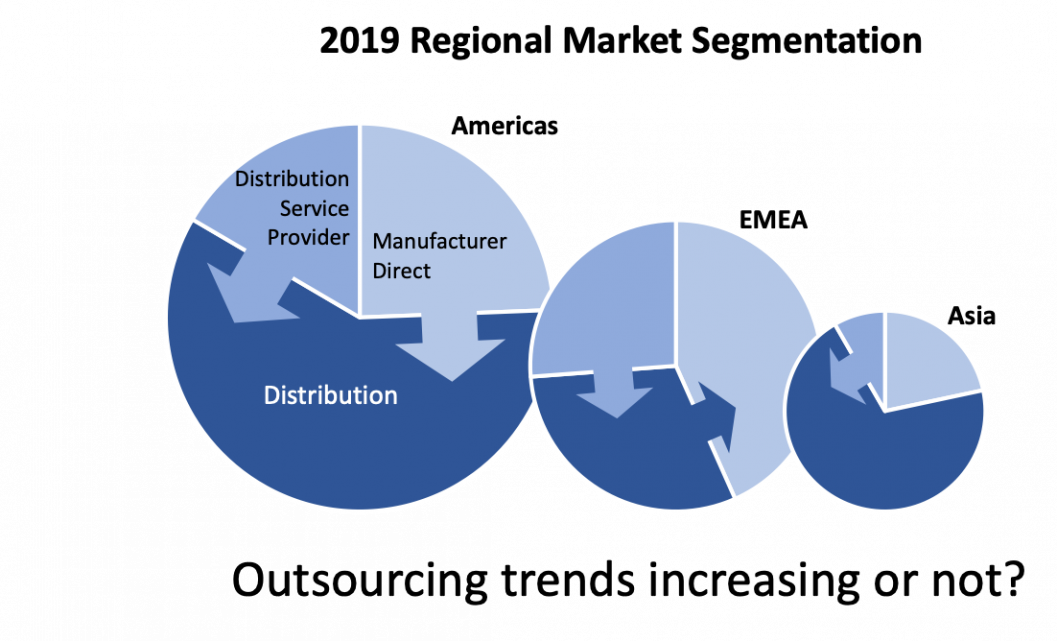

Insourcing or Outsourcing?

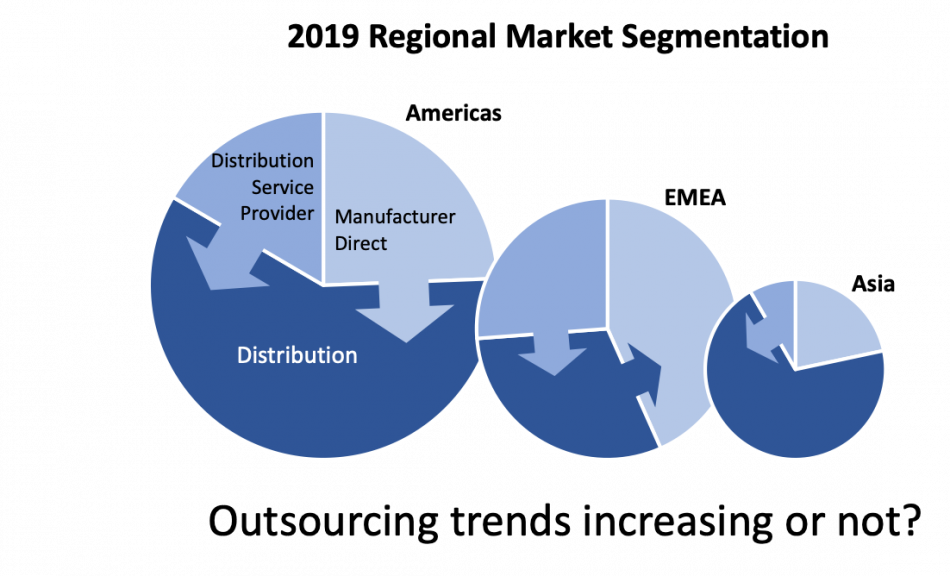

As the Regional analysis shows, insourcing and outsourcing trends can vary significantly, geographically.

All players in the market should assess the impact of these trends when considering geographic or regional revenues or investments. Are OEMs & Tiers really driving it or are external influences the dominant factor?

There is no doubt that the OEM investments upstream have a significant impact, as seen by the Boeing acquisition of KLX.

At Neologique we can help you determine where you fit within this changing environment and what the impact is likely to be in the future on your business.

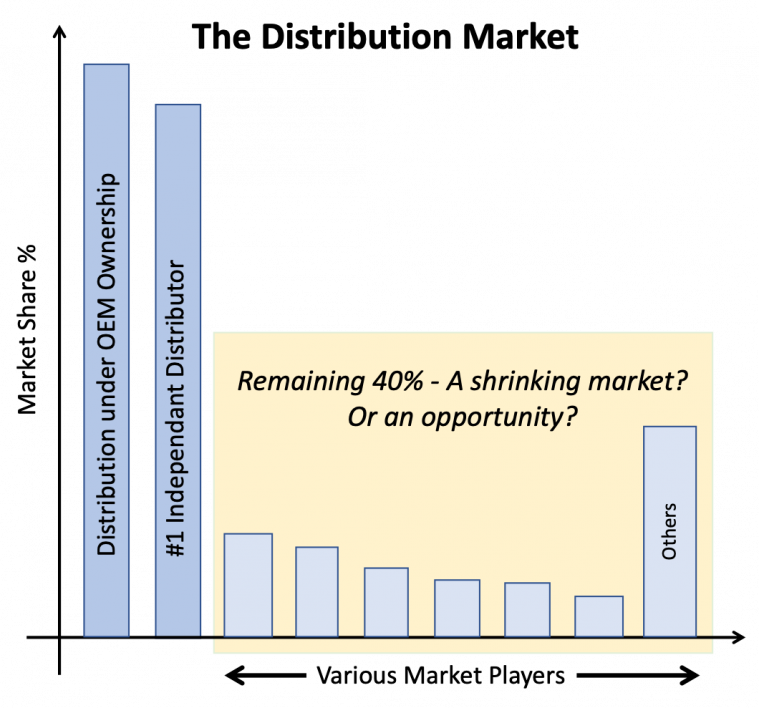

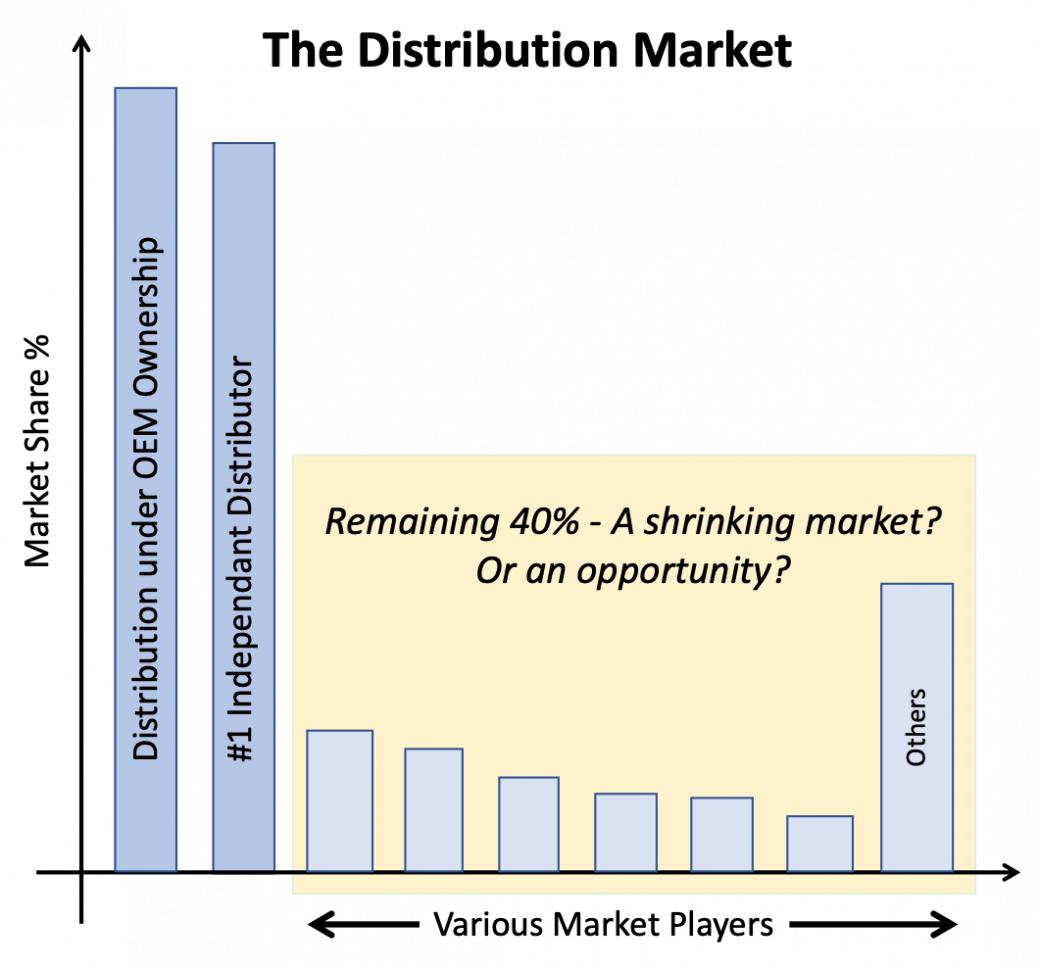

Is the Distribution market shrinking?

Major recent and pending acquisitions and consolidations show a diminishing market for the remaining players. Is it an opportunity for those players to gain share against the big guys? Is it an opportunity for the larger distributors to become even more dominant and to leverage their size against the C-Class manufacturers? Should these manufacturers look to invest and integrate downstream? If you are an OEM, what do you think about this positioning and how far upstream do you want to integrate?

At Neologique we believe that there is sufficient headroom for players in the C-Class market to expand their footprint, but the opportunities need to be identified and taken. The big players must retain flexibility, responsiveness and a keen eye on customer service or their share will be under serious pressure.

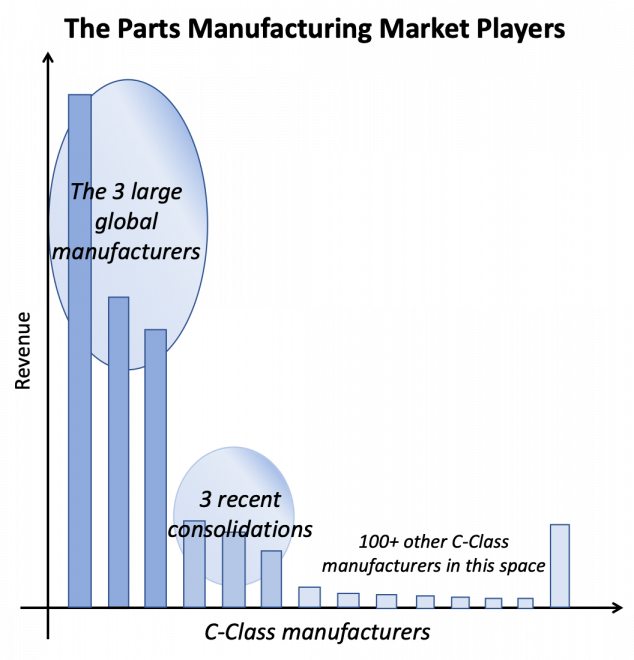

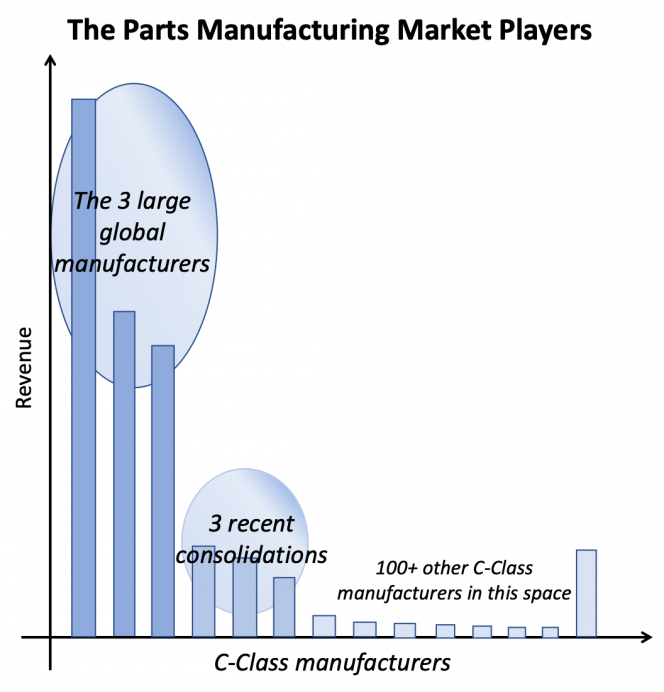

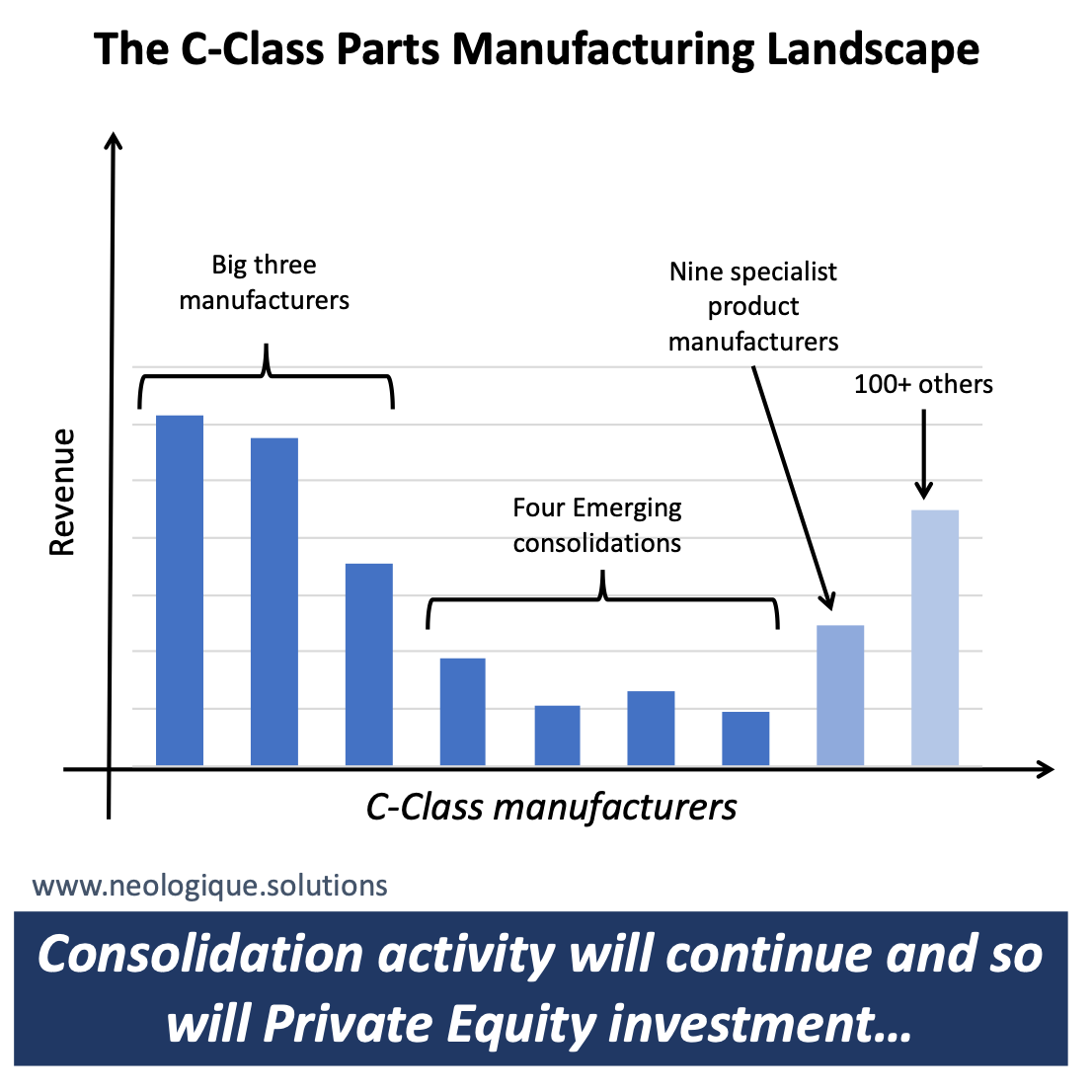

Manufacturer’s Positioning

The three large manufacturers hold more than half of the total market between them. While the three recently emerging consolidated businesses (originally 16 different businesses) only account for 15% of the market. There is much more to be done in terms of ongoing consolidation, as some 100+ mostly specialised independent manufacturers remain, probably to be gobbled up by private equity investors. And when might a merger of equals occur between the big players?

Significant investor activity is an interesting feature, set to dominate the short and medium term consolidation effort in our opinion.

Consider the impact of the Boeing acquisition of KLX which will be felt across the manufacturing environment as inventories are brought under control and prices harmonised.

Neologique can help you understand the impact.

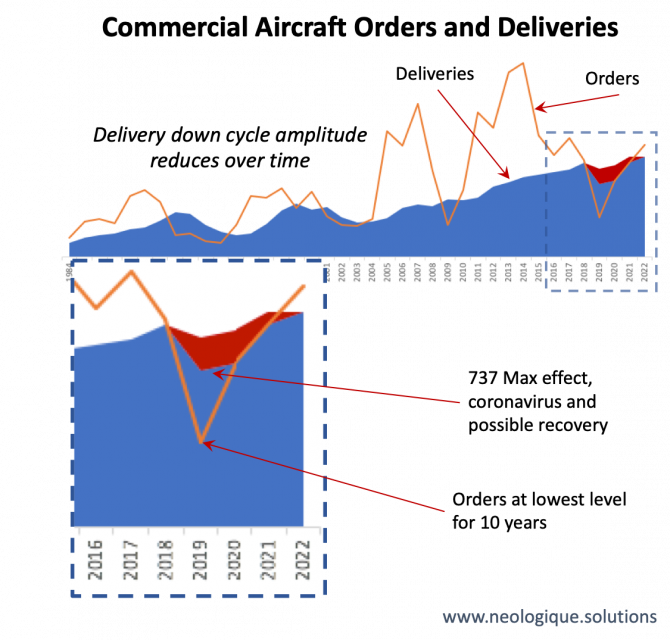

Industry cycles

Industry cycles have a direct effect on each player in the market. An investor will see a down-cycle as a good time for acquisition. OEMs will still have to balance strong order books with the reality of a weakening short term customer demand, whilst minimising the effect on its resources and the supply chain. A Distributor’s opportunity lies in taking advantage of available manufacturing capacity, harmonising the prospect of beneficial product prices with speculative stock in anticipation of the up-cycle. For parts manufacturers, it is once again the opportunity to improve the flexibility and efficiency of production whilst controlling cost.

The down cycle is upon us, exaggerated by the impact of A380 and 737 Max and the pending effect of the Coronavirus. When will the cycle bottom out and will the amplitude of the downturn reflect current trends? At Neologique we believe the repercussions will be felt by the entire supply chain for three years.

Does higher inventory utilisation necessarily mean lower profitability?

Parts distribution and service provision can be harmonious and complementary. Distribution focuses on the product and an efficient purchasing strategy, while distributors providing services focus on service levels and fees regardless of the product. Both, of course, have inventory at the core of their activity, but one loves inventory more than the othert. Which one are you?

At Neologique we know that there is an optimum and sustainable balance between Distribution and Service Provision. The answer is in the desire to manage both types of activity at a PART NUMBER level. Optimised purchasing will yield margin enhancement and improved working capital utilisation. Adding value to all concerned, not least the Customer.

Moving manufacturing landscape

The three large manufacturers hold over half of the market for C-Class components between them. While the four recently emerging consolidated businesses (originally 30) account for some 20% of the market share. Mostly specialised independent manufacturers remain, probably to be gobbled up by private equity investors. And when might a merger of equals occur between the big players?

Consolidation will continue driven by the desire to offer a broad product portfolio, in order to compete with the big 3 and offer value to the customers. Significant investor activity is therefore set to dominate the short and medium term. Contact us to learn more..

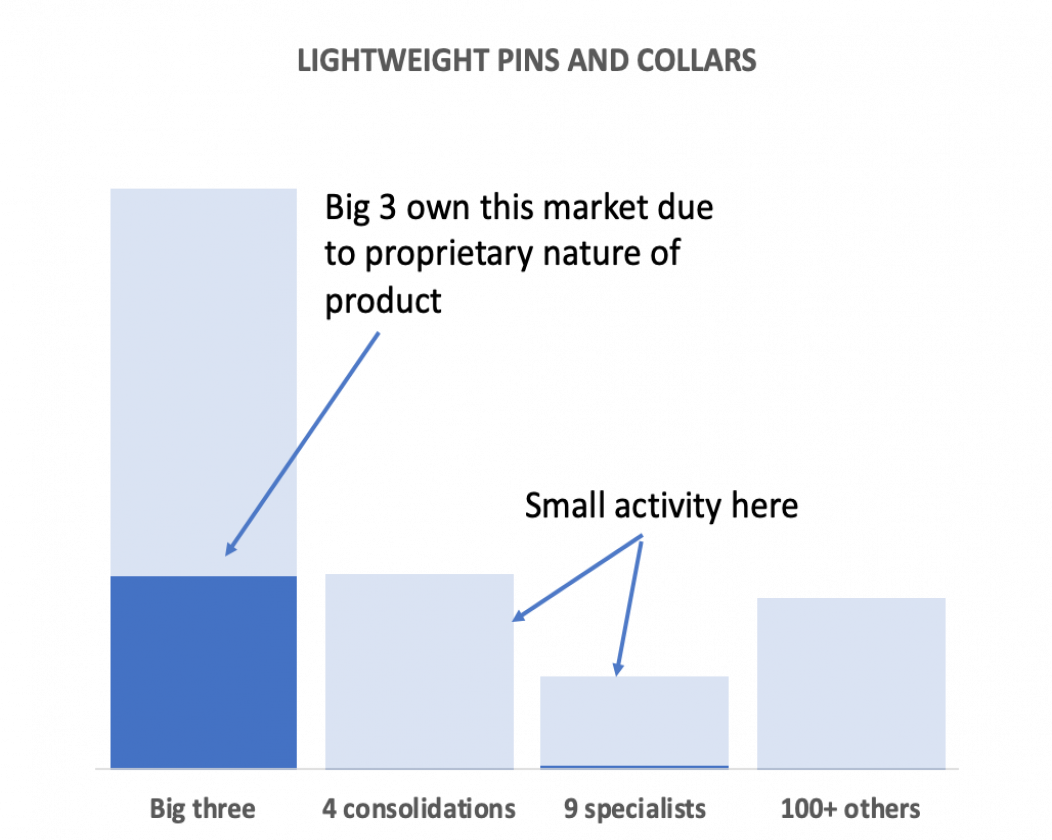

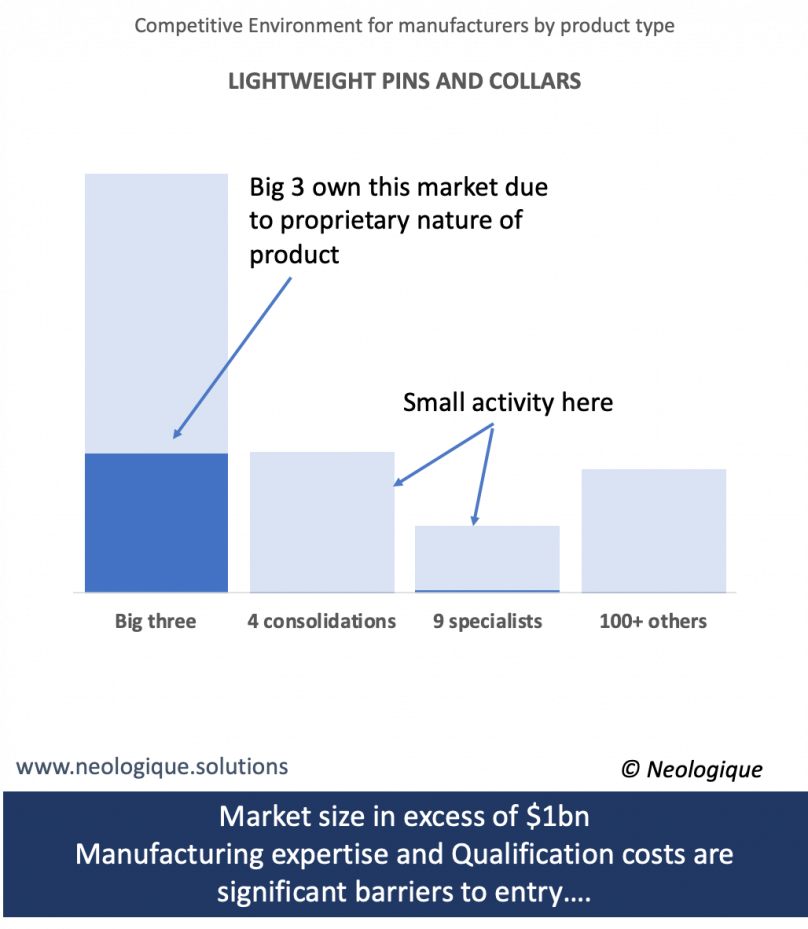

Competitive Environment by Product Type

1

Following the last post of the manufacturers’ share of the C-Class market, today we start to look at that market split into groups of product families. There are far too many families to look at them individually in such posts, although it is possible.

The importance of understanding the competitive environment in your market is crucial. Getting to grips with that at a product line level or even a part number level is highly desirous and the graph shows a summary of the market of >$1bn for lightweight pins and collars; aka Hi-Lok, Hi-Lite, Veri-Lite and Lockbolt pin and collar systems. The 3 big manufacturers are dominant in this space. What does it take to get into this market? A big investment and technical and manufacturing knowhow. Some small efforts have been made on certain products, with limited success, within the consolidated businesses and the specialist manufacturers, but there is a long way to go before the impact is felt by the big 3.

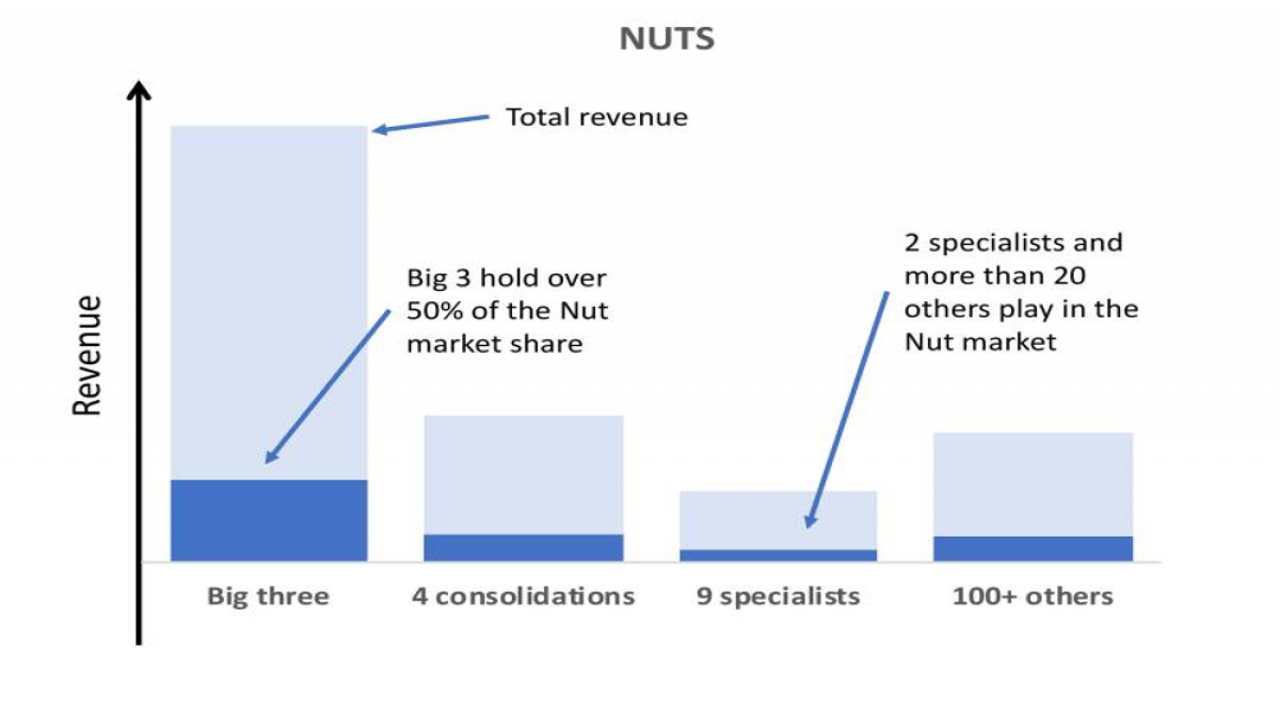

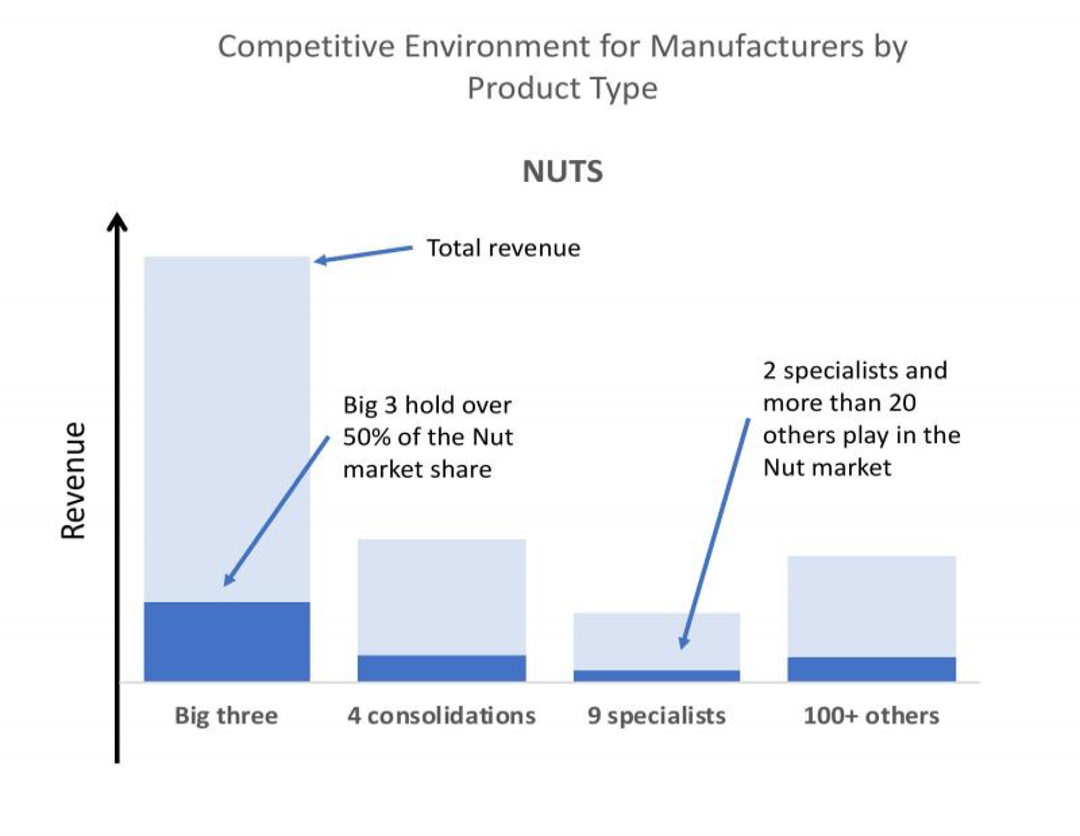

Competitive Environment by Product Type

2

Continuing the series of market intelligence posts from Neologique regarding the manufacturers’ share of the C-Class market, today we take a look at the Nut market. This study includes Engine, Airframe and Systems nuts, so the diversity is relatively wide; ranging from high strength, large diameter nickel based alloy nuts to alloy steel locknuts, plate nuts and gang channel.

The 3 big manufacturers are not dominant in this space but they do hold over 50% of the available market. Unlike the lightweight pins and collars, this product line lends itself favourably to the distribution market channel. Largely because the number of part numbers is significantly reduced due to no grip length variances, and as a result the volume by part number is significantly higher. The importance of understanding the competitive environment, by product type, in your market is crucial.

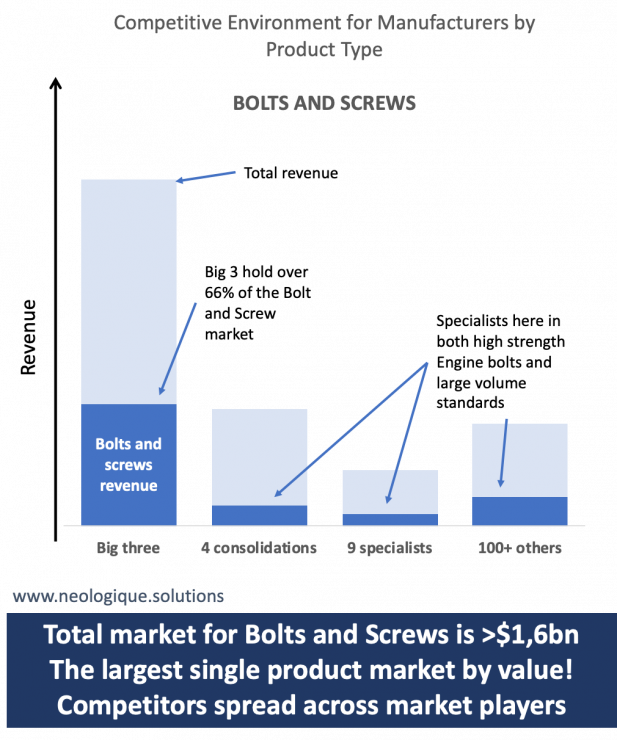

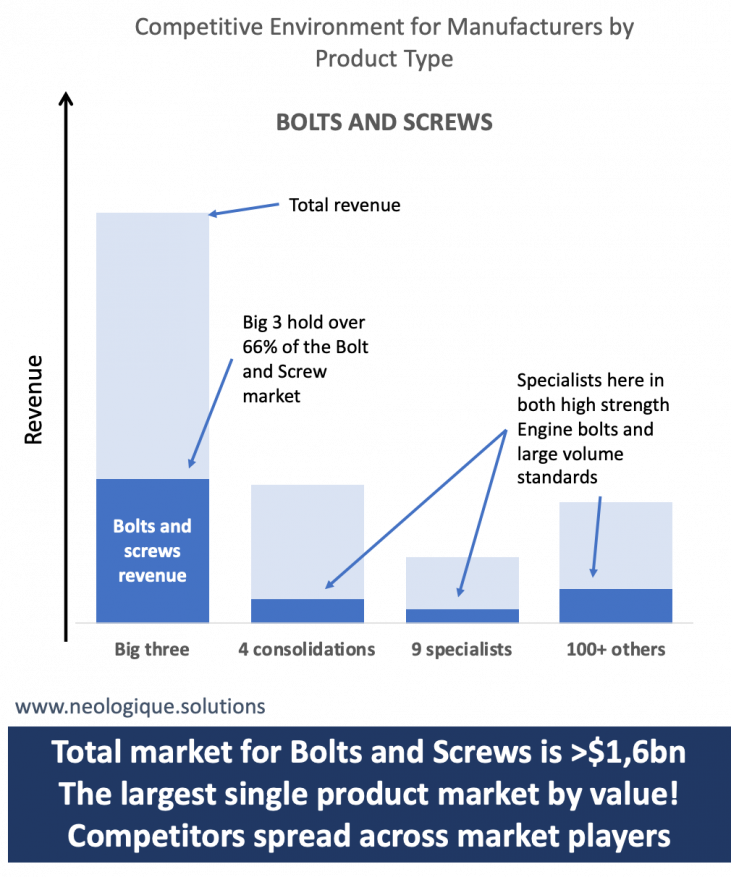

Competitive Environment by Product Type

3

This market is the largest single product type market globally, valued at over $1,6bn. The market is extremely diverse comprising variation in head style, diameter, grip length and material, thereby creating thousands of part number combinations. The big 3 manufacturers hold over 66% of this market and as one might expect the high value products are those made from exotic alloys, providing challenges in the manufacturing process and heat resistance and high strength products to the customer base. There is a broad range of suppliers throughout the supply chain, particularly when considering standard product lines like MS, NAS and AN where global volumes, by part number, are in the hundreds of thousands per year for the popular grip lengths and diameters. This diversity is problematic for the distribution world and often leads to excess and obsolete inventory, particularly in the longer grip length, smaller volume products and non-standard materials.

The importance of understanding the competitive environment, by product type, in your market is crucial and Neologique can help you to get to grips with this challenge.

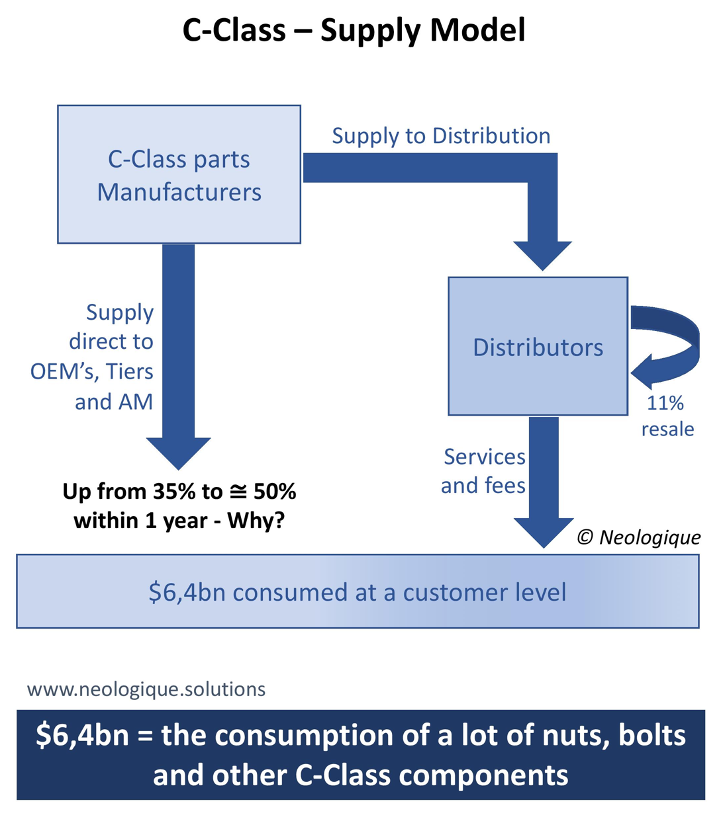

C-Class Supply Model

Following multiple changes in the C-Class distribution supply chain, we thought we would issue an updated version of a previous post on the industry supply model.

Why do the product users spend nearly $1bn more annually for the same manufactured product? And why has the manufacturers direct sales to the end-user increased to around 50% of the total consumption. Will this trend continue and is the move to outsourcing really declining? We believe that there are two opposite forces at play that merely shift the balance from time to time. We also believe that distributors need to re-engineer their service offerings to keep their market share.

It is a fundamental requirement to understand this equation and its drivers.

Tailor-made Analysis & Strategies

At Neologique, we understand that businesses have unique strategic positioning, requiring the support of different market analyses. So, we have developed bespoke studies, at the request of our clients, designed and delivered to meet these specific requirements.

If you want to know more about the C-Class aerospace markets, the sectors, the supply chain, the players, their market shares, the products, M&A opportunities, outsourcing evolution or any other related topic, get in touch with Neologique today.

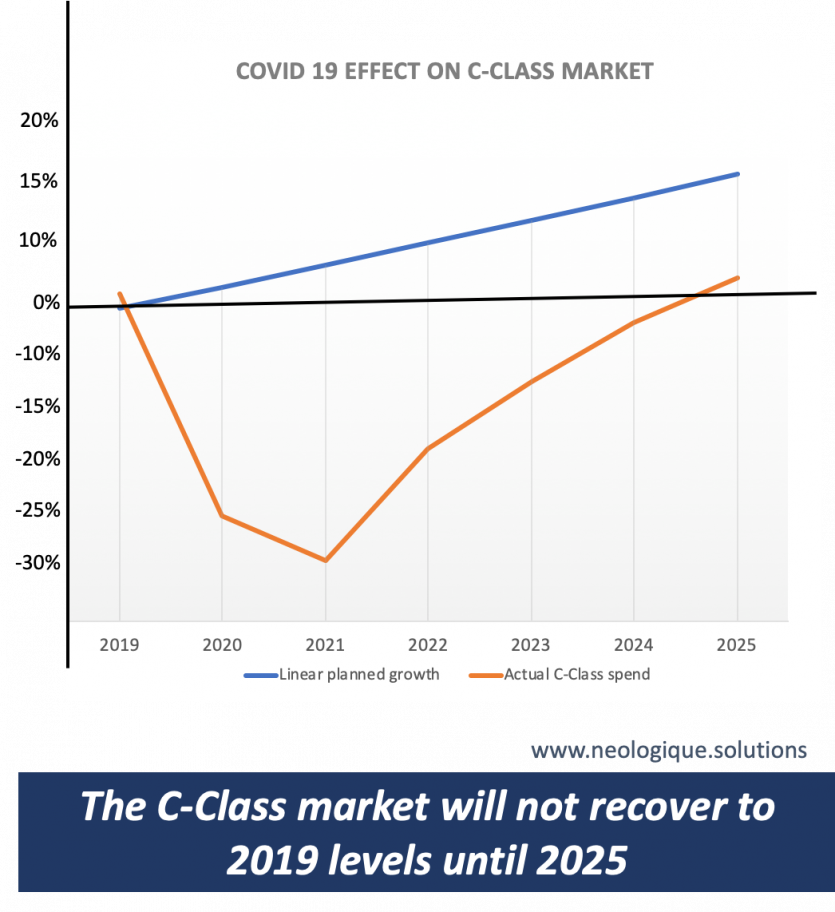

When will the aerospace industry recover from Covid-19?

Everyone has felt the impact of coronavirus and the aerospace industry has certainly suffered the brunt of it. Neologique Solutions has taken a deep look into the C-Class aerospace market considering not just the effect on direct OE build rates and the MRO and Aftermarket, but also the deeper, and often underestimated, influence of factors like the inventory excess that remains in the supply chain and the Boeing acquisition of KLX. These, offset to some degree by growing military programmes and government interventions.

Still, we are in the middle of a 30% downturn in our industry that takes us through 2021, the year where we will see the bottom of the decline and $2 billion wiped off the annual purchase value of C-Class parts. We don’t see a return to global 2019 levels until 2025, where a significant gap to the industry plan prior to the pandemic prevails (chart shows a modest 2,3% growth per year). The impact will of course vary by sector and region.

Sorry for the depressing news but if you would like to know more about the Covid-19 impact please contact Neologique Solutions.

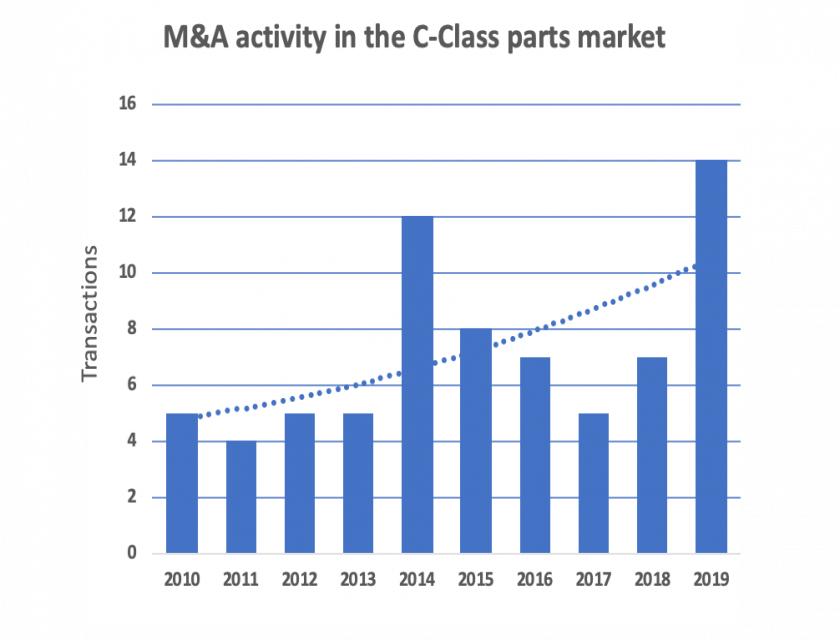

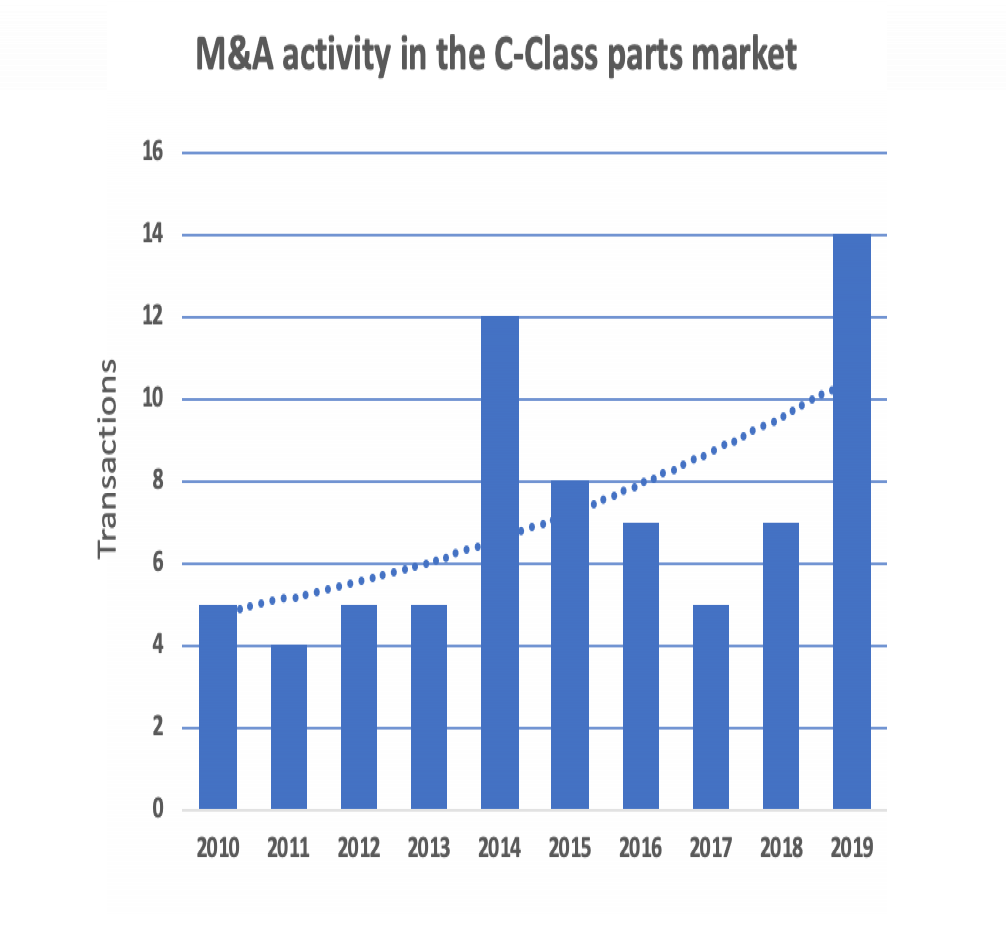

M&A activity in the C-Class parts market

83 different entities have either exited the C-Class space or have been swallowed up in acquisition transactions, led by less than 10 major industry players. We have seen a 32% increase in activity in the last 5 years versus the prior 5 year period.

The big question is whether the Covid-19 pandemic will drastically reduce the current trend or whether the market players will see an opportunity to strategically align their businesses now, in readiness for the upturn which is anticipated to start next year (see previous posts).

Whatever happens, Néologique Solutions is here to help you with your M&A strategy and execution.

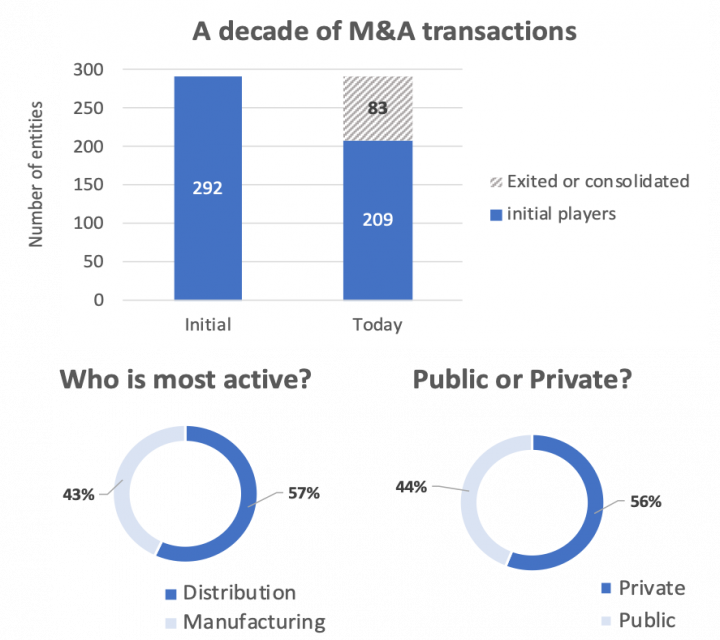

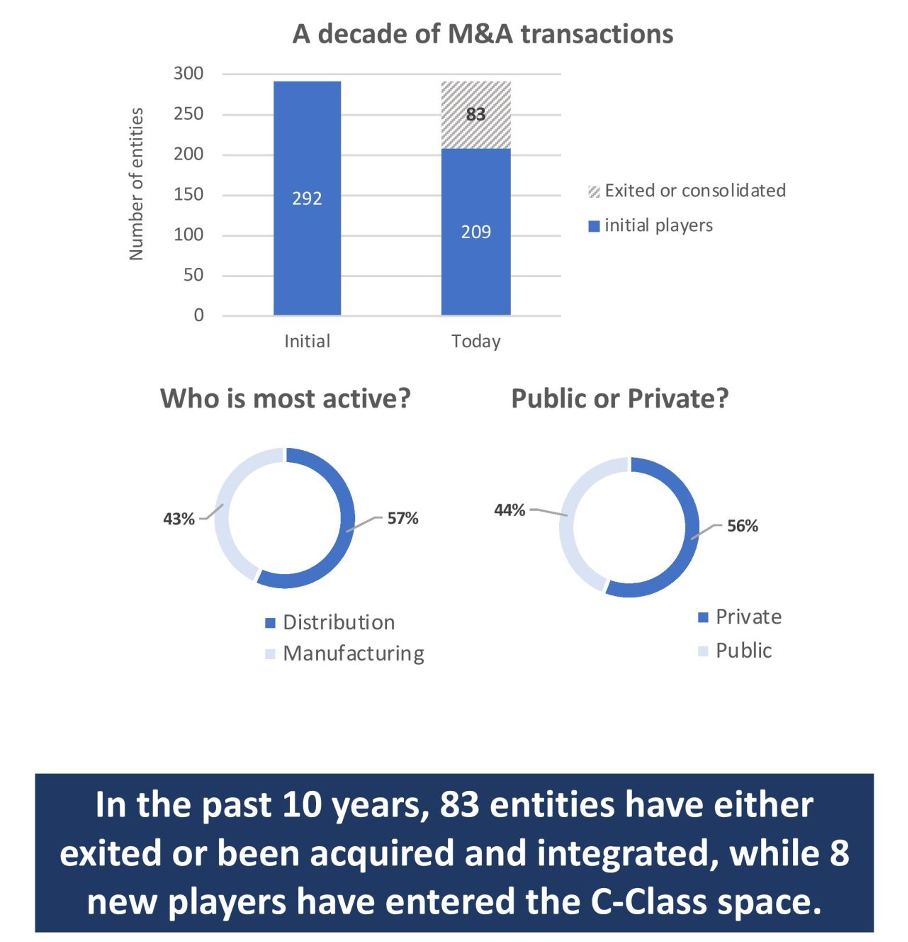

A decade of M&A transactions

Whilst it is true that most of the 83 disappearing entities are related to acquisition and consolidation, it is also true that Private Equity ownership has evolved. PE funds have been, and will continue to be, extremely active in developing an increasing share of the C-Class market, (KKR, Platinum…) Out of 8 new market players, 6 are financial funds.

The next move at an OEM level is uncertain. Who will follow AVIC and Boeing into the C-Class market? Airbus?

60% of all transactions were carried out by 18 players (10 dominant).

The distribution market proved to be a little more active than the manufacturing sector with 57% of the transactions, whilst a similar level of involvement was recorded for private ownership companies versus publicly traded businesses.

At Néologique we believe that investment into the C-Class parts market will continue its growth cycle, following a predictable lower level of activity in 2020.

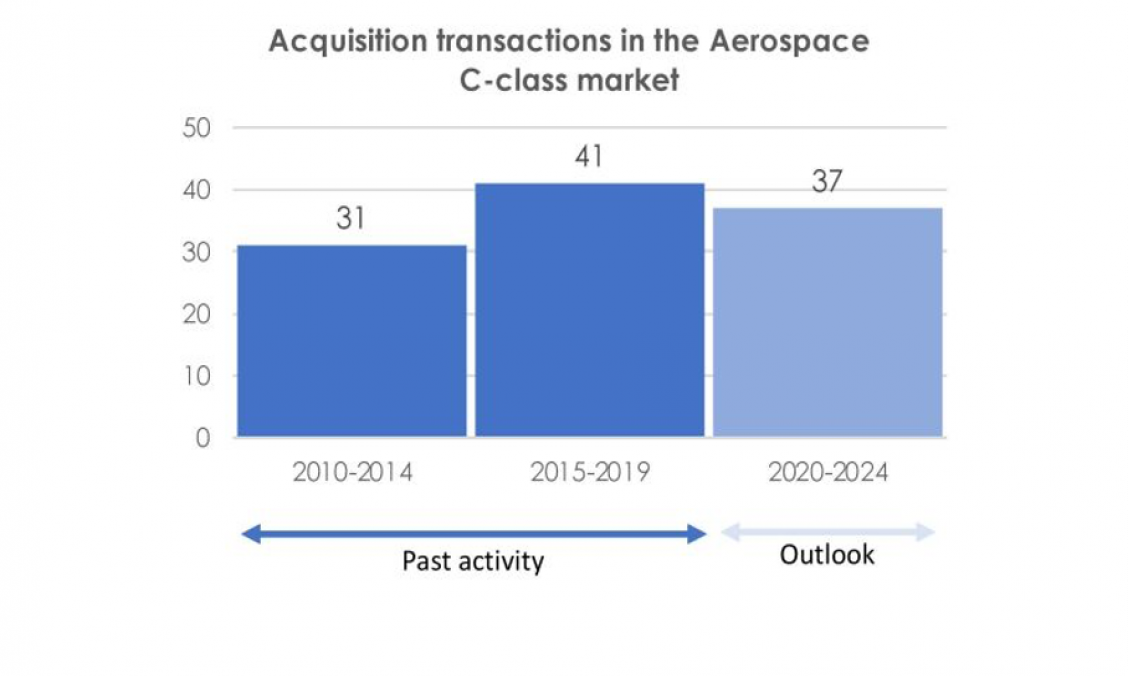

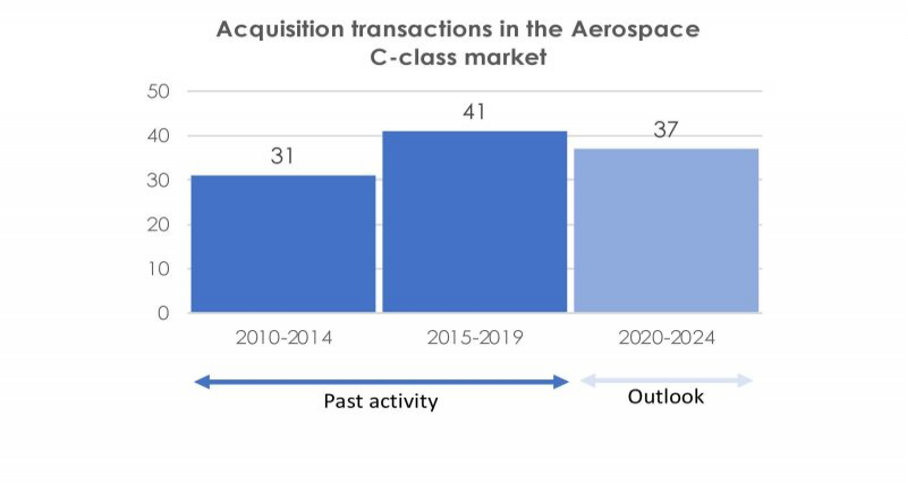

Acquisition Transactions

in the Aerospace C-Class Market

Néologique believes in the Aerospace market sector and its bounce-back ability. Having lived through 4 major down-cycles, we have seen this great industry cut back and return stronger, more responsive and more agile than ever before. The outcome following this pandemic will be no different. This is why the attractiveness of investment into this space will continue to grow. There were 8 new investors in the last 5 years and there will be more in the next 5. The businesses that emerge as powerful entities after such a crisis are those that do not “ride out the storm”, they are those that use the downturn to immediately re-engineer their business, its processes and investments in a proactive way.

If you have an acquisition plan based on regional presence or product expansion or a even a divestiture plan, Néologique can help you realise your goals, as specialists and experts in the C-Class market space.

How to stand

out from the crowd?

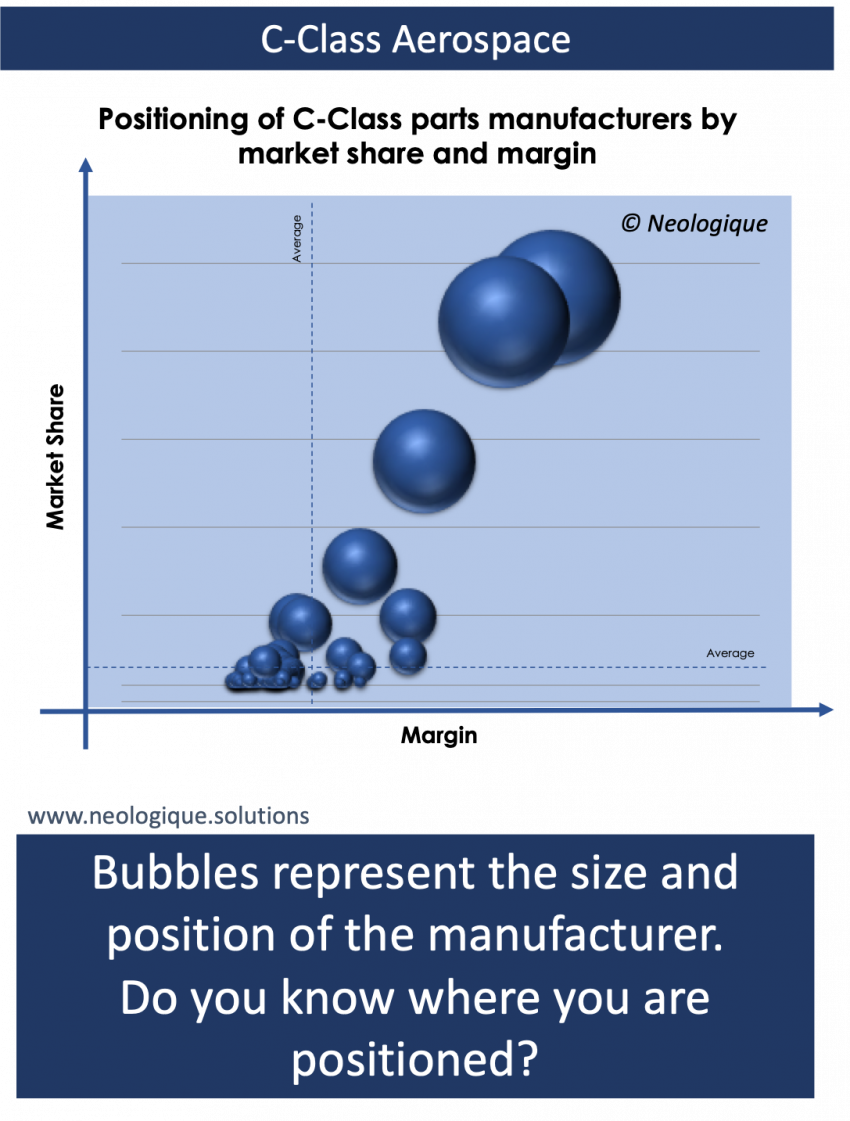

The first in a series of strategic positioning posts from Néologique Solutions.

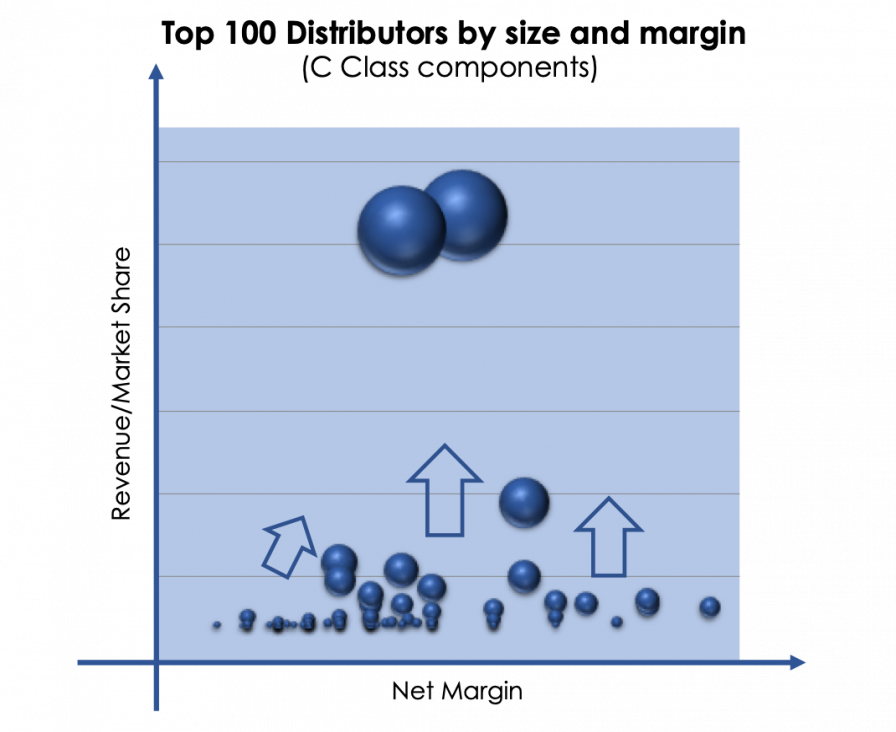

The bubble chart shows the top 100 distributors in the aerospace C-Class components market, positioned by their market share and margin. Of course, the two large players are well known to everyone, but most distributors are in the lower part of the chart. So, if you want to outpace the pack, how do you improve your margin or increase your geographic presence or determine which products or sectors (airframe, engine, systems, military or aftermarket) to focus on?

Whilst ‘size’ isn’t everything, it is critical when positioning to compete on the global stage. Similarly, being able to compete on the global stage isn’t everything, but driving value into the business for the stakeholders, whilst not being marginalised, is!

We can help you understand where you fit in this competitive environment and how you might be able to make changes that really make a difference, Or we can help to develop an acquisition or investment strategy that will shift the balance.

How do Products & Services contribute?

Knowing how each one of your services or products performs for the business is crucial as you strive to enrich the returns for your stakeholders. Every little incremental improvement will flow to the bottom line. All of the products or services in the chart will have their own story to tell and an individual strategy to be developed, that together will combine to enhance the overall company results. Can you afford not to review your progress this way?

The model applies well to both products from the manufacturing base and services from distributors and logistics providers.

What would you do with Product 2? Maybe reduce prices? Or leave it where it is? An interesting dilemma.

Néologique can assist you on your journey…

Where are we?

Continuing the Strategic Positioning series on C-Class components and following a similar post on the Distribution market, here is a view of the positioning of the Manufacturers of C-Class components. It is interesting to see that there are also two dominant players, but with a difference; here it appears that size is proportional to margin. Probably supported by the proprietary nature of some of the products and the large volumes that the bigger players can supply.

Consolidation remains to be a huge opportunity for those striving to bridge to gap.

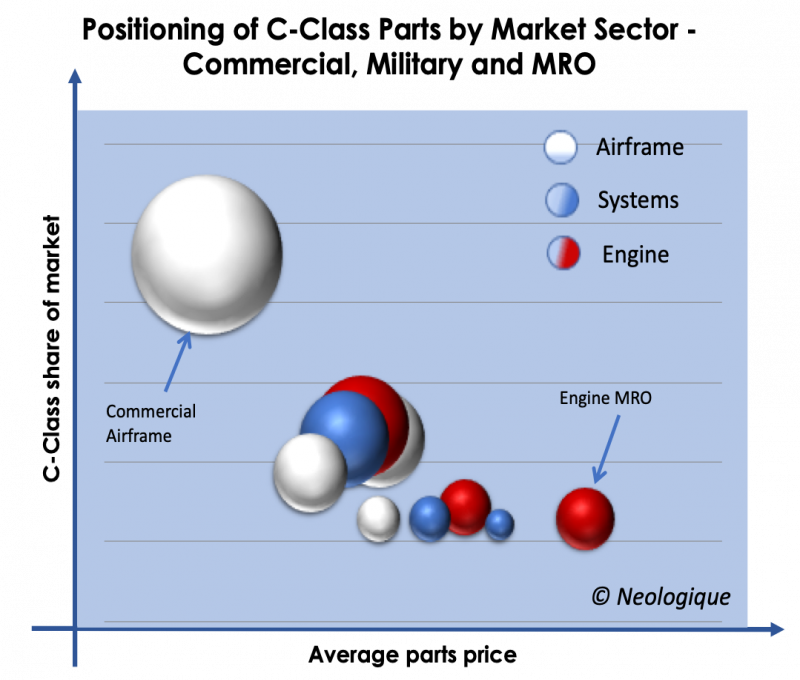

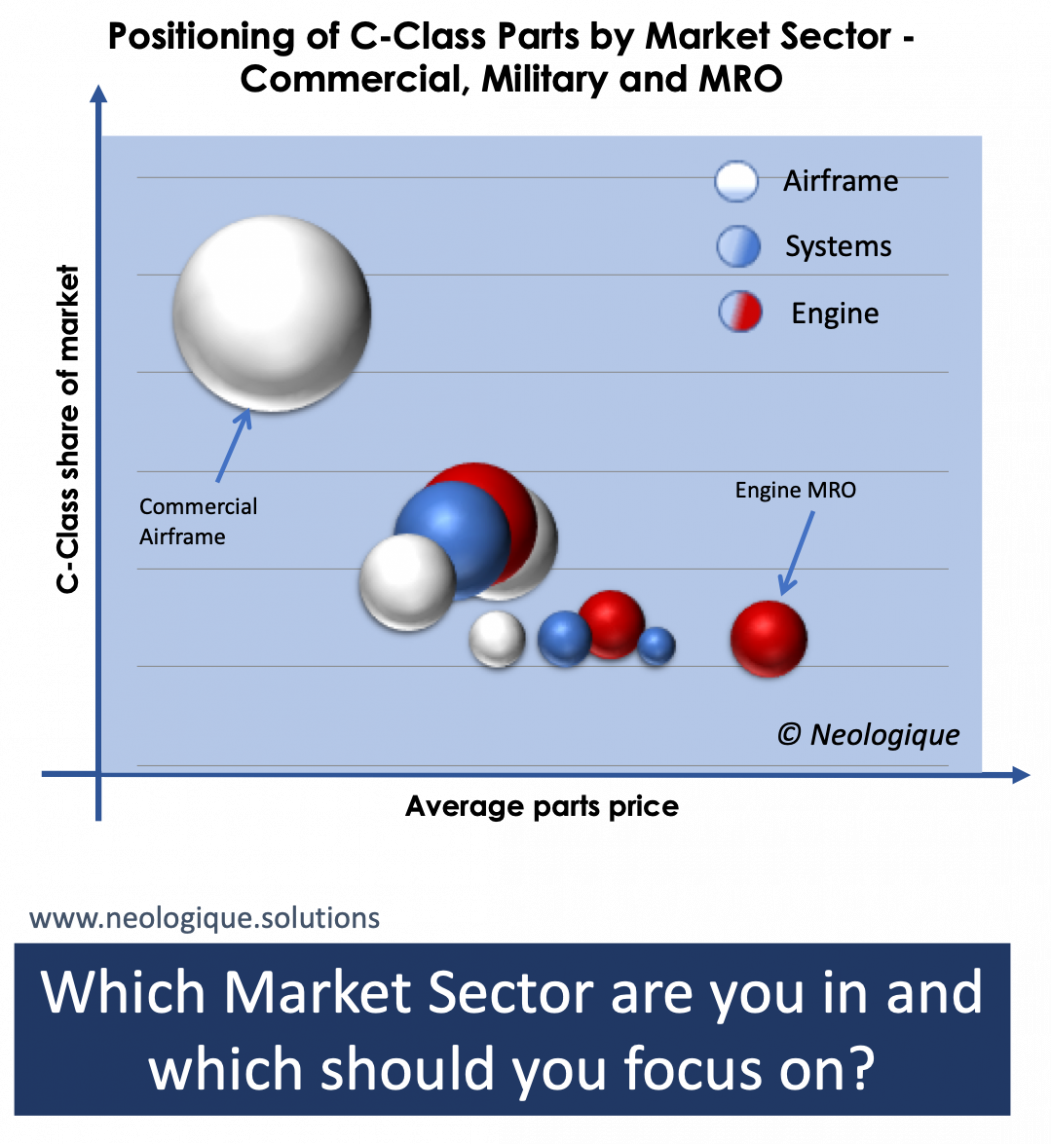

Strategic Positioning & Market Sectors

The commercial Airframe consumption of C-Class components makes it the largest and most competitive sector, with over 35% of the total market for Aerospace C-Class parts. The Engine MRO market provides the highest average price opportunity but clearly the material technology and the volumes of product consumed in this sector are significantly different from that in the Airframe sector.

If you want to optimise your production processes or your distribution purchasing and inventory strategy then you need to be aware of the headroom in the market sector you are playing in. Where are the opportunities to optimise margin? And who are the competitors in the space?

Would you like to understand more?

Competitive

& Market Intelligence

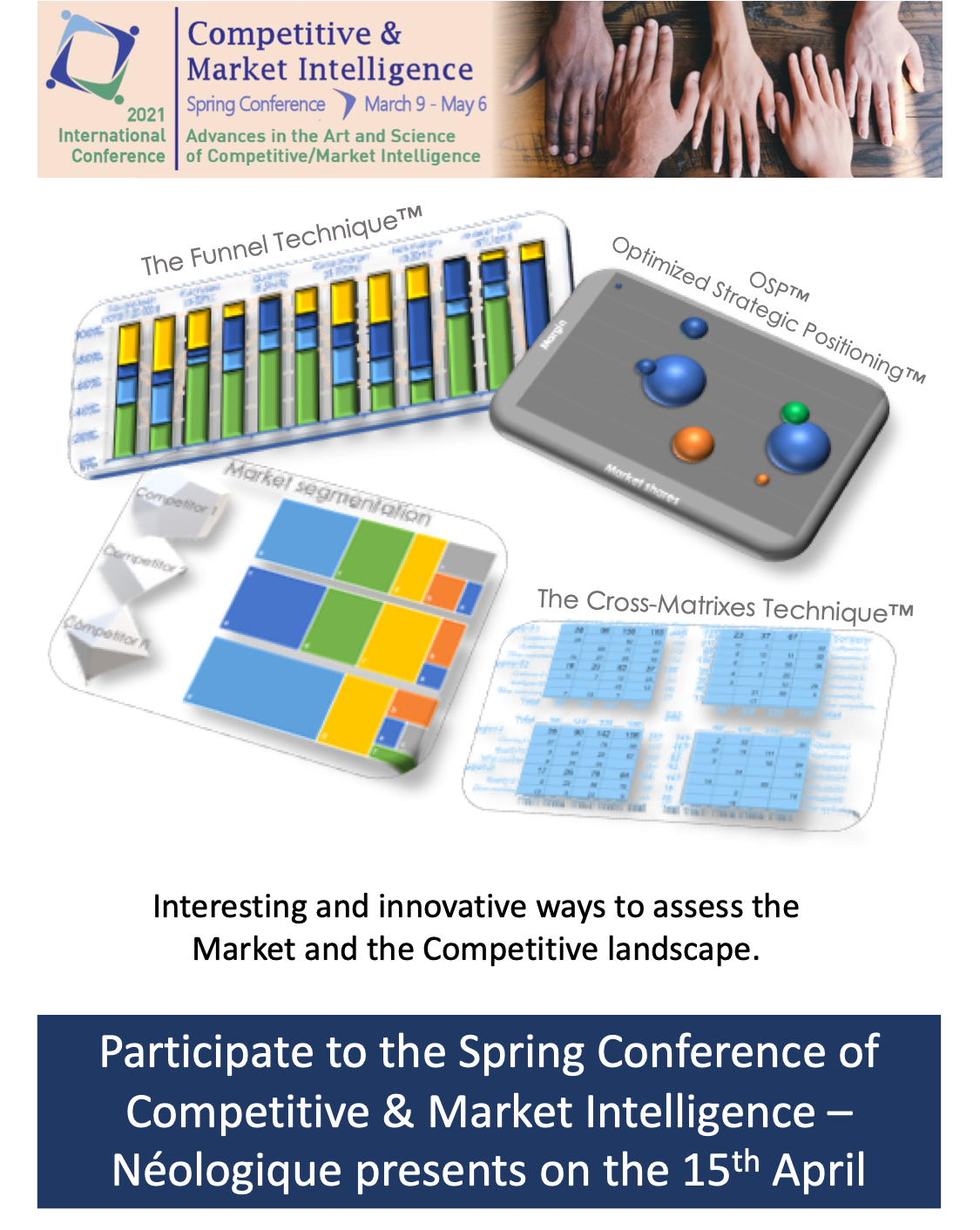

Néologique is delighted to be a part of the ICI 2021 International Conference on Competitive and Market Intelligence.

Competitive & Market Intelligence

Néologique is excited to be presenting at the ICI Competitive & Market Intelligence Conference. We know that any business splits into distinctive homogeneous strategic segments, combining growth, profitability, market sectors, product type, technology, production set-up, etc.

We use developed and bespoke techniques to simplify, often complex businesses and how they look at themselves, so that clarity of direction results.

The Funnel Technique™ is used to understand how a business segment contributes to overall performance. Which segment is most contributing to EBITDA? Often it is not the segment contributing more at the GM level!

The Cross-Matrix Technique™, is a multi-dimensional approach to achieve reliable market data. Using both bottom-up and top-down principles.

OSP™ (Optimized Strategic Positioning™), uses synthetic elements like profitability, market share & growth to determine strategic direction, whether in Production, Purchasing, Marketing & Sales, Finance or R&D and Engineering.

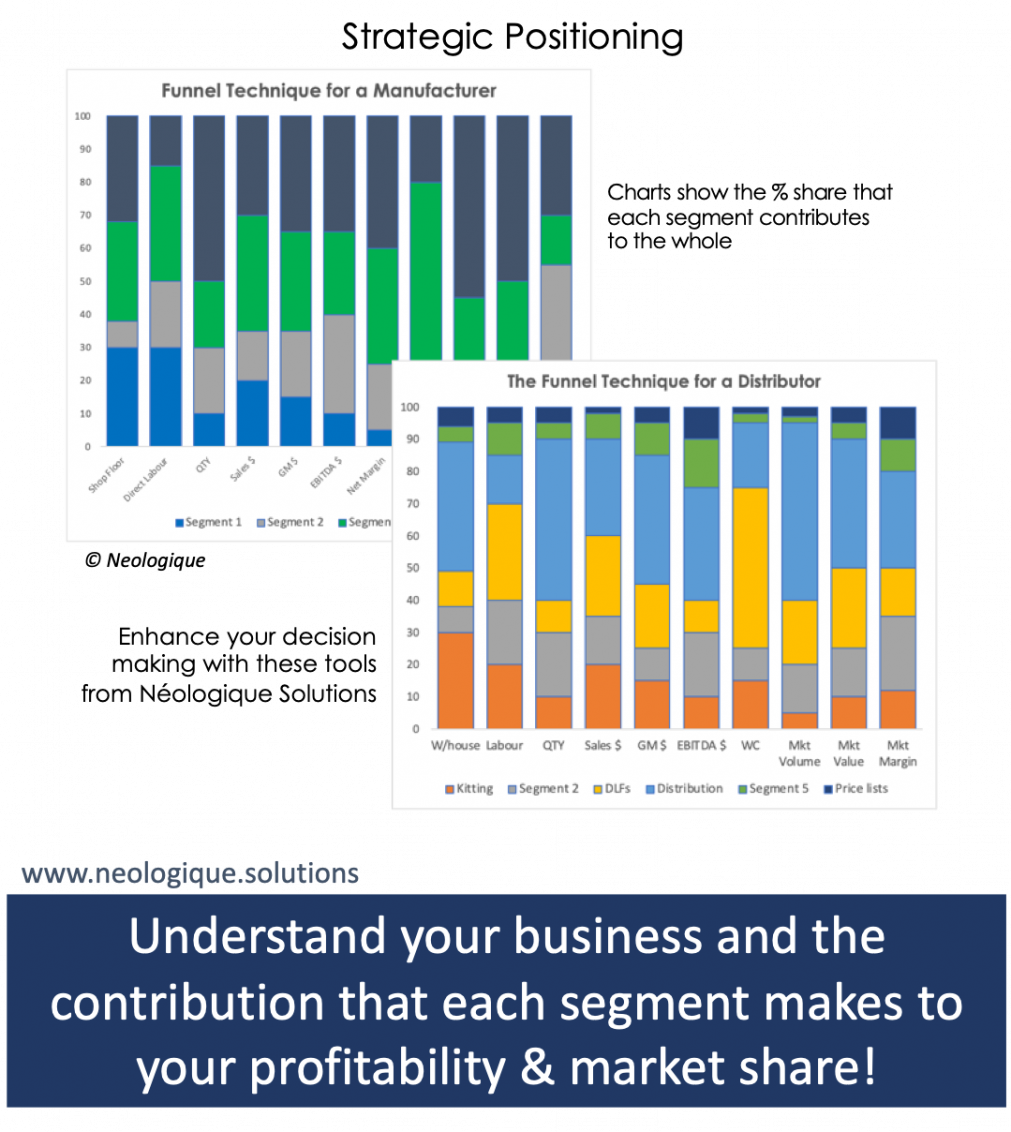

The Funnel Technique™

All businesses can be split into distinctive homogeneous strategic segments, combining growth, profitability, cost structure, market sector, product type, technology and production process.

It is important to figure out how each segment contributes Commercially (volume, revenue, margin), Operationally(direct labour, purchases, capital expenditure), Financially (overheads, working capital, debt, interest, tax, depreciation) and with a view on the Market (market share of available volume, revenue and profit).

This method is our Funnel Technique™

Once completed, decision making becomes clear and justifiable, e.g.

- Which segment is most contributing to EBITDA (which often is not the segment contributing most at the GM level)?

- Where does it make sense to spend effort and resource on reducing costs?

- Where to invest further?

Néologique can help you do it “in no time”.

The Cross Matrix Technique™

At Neologique, we know how to estimate almost any market, and we always do it both in volume and in value, which avoids often unreliable underlying price variances. Called the Cross-Matrix Technique™, and mathematically demonstrable, it results in reliable market data (+/- 5%), by using ad hoc matrixes like application x product, customer x application, competitor x products and country x market sector. All with a focus on the element of profitability.

The beautiful aspect of this methodology is that the multi-dimensional approach is self-ratifying (useful in complex and immature data set situations). We transform information into data, qualitative estimates into quantified data, and where necessary, using the power of analogy and progressive deductions based on best plausibility.

Neologique can quantify your served & potential markets, giving you the time to focus on your core activity.